- Global FinTech Infrastructure Trends (2025–2026)

- Why Cloud Infrastructure Is Non-Negotiable in FinTech

- DevOps in FinTech: An Industry-Wide Maturity Gap

- What Makes a Great FinTech DevOps Partner?

- Spotlight: Gart Solutions

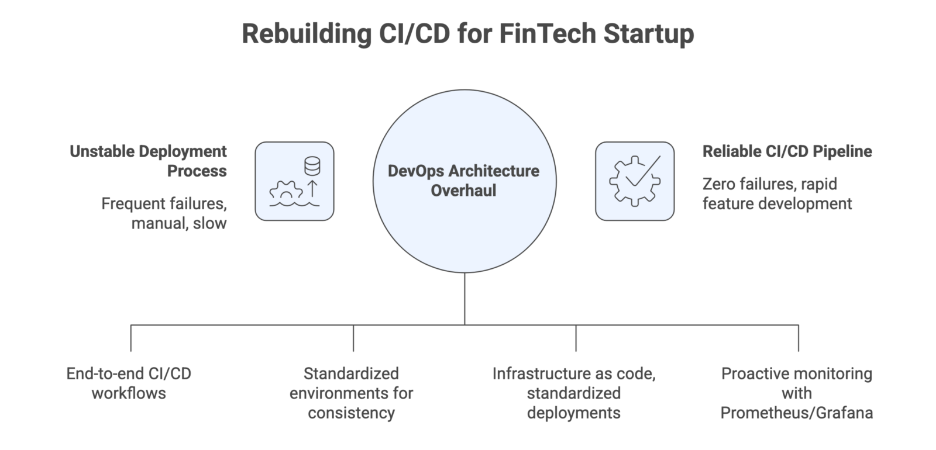

- Gart in Action: FinTech Case Studies That Matter

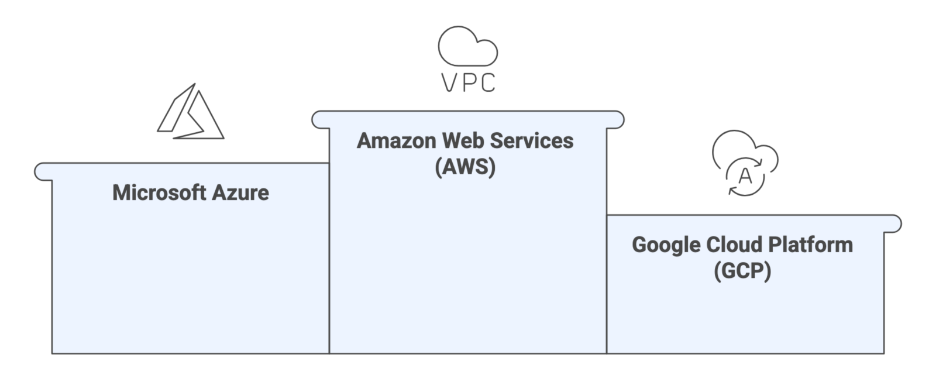

- Top Cloud Infrastructure Providers for FinTech

- Best DevOps and Software Engineering Companies in FinTech

- Gart vs. Traditional MSPs: A Comparison

- Gart’s Platform Engineering Philosophy

- Security in FinTech: DevSecOps and the New Normal

- The Regulatory Environment: GENIUS Act, EU AI Law, and Beyond

- The AIOps Transition in FinTech

- Conclusion

The financial technology (FinTech) industry isn’t what it used to be. Gone are the days of scaling at all costs, fuelled by endless VC funding. Welcome to 2026 — a world where performance, resilience, and compliance define success. Today, FinTechs demand DevOps pipelines that can ship code fast and securely, cloud infrastructure that bends without breaking, and engineering teams that understand the complex regulatory and real-time requirements of modern finance.

And at the heart of this shift? Companies like Gart Solutions — a boutique powerhouse helping fast-growing FinTechs build smarter, scale faster, and sleep better at night. In this comprehensive review, we’ll explore the global FinTech DevOps and cloud infrastructure ecosystem, spotlight top providers, and explain why Gart Solutions is turning heads as one of the most trusted partners in this space.

Global FinTech Infrastructure Trends (2025–2026)

We’re in the middle of a tectonic shift. FinTech companies are moving away from rapid-growth strategies toward operational sustainability. According to market analysis, the FinTech cloud infrastructure market is set to explode — from $44.4 billion in 2021 to nearly $196.2 billion by 2031.

Several factors are pushing this transition:

- The mainstreaming of real-time payment networks like FedNow and RTP.

- The rapid adoption of generative AI in underwriting and service delivery.

- Increased regulatory complexity requiring proactive compliance integration.

Infrastructure is no longer just a cost center — it’s a competitive weapon. FinTechs that can harness scalable, secure, and responsive DevOps practices will be the ones leading the charge into the next decade.

Why Cloud Infrastructure Is Non-Negotiable in FinTech

Cloud computing isn’t optional for FinTech — it’s essential. The “Big Three” cloud giants dominate:

- Amazon Web Services (AWS): 30% market share

- Microsoft Azure: 20% market share

- Google Cloud Platform (GCP): 13% market share

Why do FinTechs rely on them? Because they bring:

- Massive service catalogs tailored to financial workloads

- Global compliance certifications (e.g., PCI DSS, ISO, FedRAMP)

- Low-latency computing for real-time processing

For example, AWS supports everything from threat detection with GuardDuty to full audit compliance through AWS Artifact. Meanwhile, Azure’s Payment HSM ensures low-latency payment processing. GCP, on the other hand, is leading the charge in AI/ML-powered trading systems with sub-2 microsecond tick-to-trade latency.

DevOps in FinTech: An Industry-Wide Maturity Gap

Here’s the truth: Most FinTechs aren’t shipping software fast enough. Despite nearly universal cloud adoption, only 14% can release a new product in under three months. That’s because:

- Compliance audits delay deployments.

- Security reviews happen too late in the cycle.

- Legacy infrastructure slows everything down.

The answer? Specialized DevOps partners who understand the intricacies of regulated financial environments and can integrate security, scalability, and speed into every step of the pipeline.

What Makes a Great FinTech DevOps Partner?

A true FinTech DevOps partner is more than just a CI/CD expert. They bring:

- Cloud-native expertise across AWS, Azure, GCP

- End-to-end monitoring and observability

- Cost optimization techniques (Spot VMs, autoscaling)

- Built-in compliance pipelines (policy-as-code, DevSecOps)

- Resilience engineering for high-availability systems

It’s not about deploying fast — it’s about deploying smart, with every piece of the infrastructure designed for uptime, user trust, and long-term value.

Spotlight: Gart Solutions

When it comes to agile DevOps and cloud infrastructure in FinTech, Gart Solutions has carved out a distinct position. Known for its hands-on approach, Gart specializes in DevOps transformation and cloud modernization for fast-growing SaaS and FinTech firms.

Key Strengths:

- Expertise across Azure, AWS, and Google Cloud

- Massive cloud cost savings (e.g., 81% reduction using Azure Spot VMs)

- Deep focus on SRE, observability, and automated scaling

- Tailored solutions for startups and mid-size enterprises

Gart in Action: FinTech Case Studies That Matter

Rebuilding a Broken CI/CD Process for a LATAM FinTech Startup

Read the full case study →

The Challenge

A promising LATAM-based FinTech startup was hitting a wall. Their deployment process was unstable, prone to frequent failures, and heavily manual. The lack of automation was slowing innovation, frustrating engineers, and posing risks to business continuity.

They needed a reliable CI/CD pipeline — one that could support rapid feature development without compromising stability.

The Solution

Gart Solutions stepped in with a complete DevOps architecture overhaul:

- Introduced GitHub Actions for end-to-end CI/CD workflows

- Containerized all environments with Docker

- Standardized deployments via Terraform and Helm charts

- Implemented proactive monitoring using Prometheus and Grafana

The transformation also included automated tests, rollback mechanisms, and zero-touch deployments, boosting confidence across the development team.

The Result

- Deployment failures reduced to zero

- Lead times for new features cut by over 60%

- Infrastructure changes are now managed entirely as code, enabling full traceability

“Before Gart, deployments were a gamble. Now, it’s a system” said the CTO of the LATAM startup.

This project highlights Gart’s strength in building from the ground up — turning chaos into controlled, scalable DevOps systems tailored for the fast-moving FinTech space.

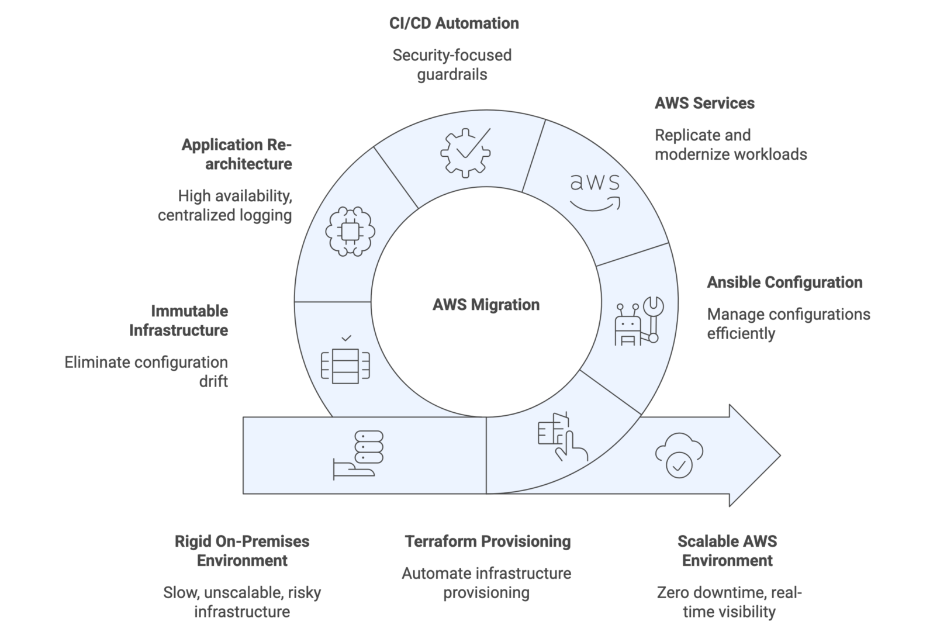

On-Prem to AWS Migration for a Financial Services Company

The Challenge

A mid-sized financial company faced the classic problem: a rigid, aging on-premises environment that couldn’t scale. Infrastructure provisioning was slow, disaster recovery was nearly impossible, and compliance updates were manual and risky.

Their vision was cloud-first — but they needed a partner who could migrate without disruption and build a foundation for DevOps maturity.

The Solution

Gart Solutions orchestrated a full-scale migration to Amazon Web Services, leveraging:

- Terraform for infrastructure provisioning

- Ansible for configuration management

- S3, RDS, EC2, and CloudWatch to replicate and modernize their workloads

- CI/CD automation with security-focused guardrails baked in

More importantly, they re-architected applications for high availability, implemented centralized logging, and created immutable infrastructure patterns to eliminate configuration drift.

The Result

- Entire infrastructure migrated with zero downtime

- Monitoring and alerting systems enabled real-time visibility

- Compliance audits are now faster and easier thanks to automated reports

This wasn’t just a lift-and-shift — it was a full modernization that aligned infrastructure with long-term business goals.

“ROI isn’t a buzzword here. It’s our compass,” emphasizes Fedir Kompaniiets, CEO of Gart Solutions. Gart’s portfolio proves its ability to help FinTechs launch faster, operate leaner, and scale without breaking under pressure.

Top Cloud Infrastructure Providers for FinTech

While boutique DevOps firms like Gart Solutions are delivering massive value, none of it is possible without the bedrock of strong cloud infrastructure. Here’s how the “Big Three” stack up in the FinTech space:

Amazon Web Services (AWS)

- Market Share: 30%

- Strengths: Largest service catalog (200+), mature partner ecosystem, high-performance compute

- Compliance: 143 certifications including PCI DSS Level 1

- Use Cases: Real-time fraud detection, lending platforms, digital wallets

AWS is ideal for FinTechs looking for maximum flexibility and scale. Institutions like RBC Royal Bank and United Airlines trust AWS for secure deployments and rapid innovation. Tools like Amazon GuardDuty and CloudTrail make it easy to integrate threat detection into the SDLC. And with their Shared Responsibility Model, fintechs retain control where it matters—at the app layer.

Microsoft Azure

- Market Share: 20%

- Strengths: Hybrid cloud mastery, Microsoft ecosystem synergy

- Compliance: Azure Payment HSM, FedRAMP, ISO 27001

- Use Cases: Digital banking transformation, AML systems, core banking infrastructure

Azure shines for enterprises transitioning from legacy systems. Its Hybrid Benefit allows reusing Windows and SQL Server licenses in the cloud—saving time and money. Its bare-metal Payment HSM hardware makes Azure perfect for real-time payment processing and compliance-heavy financial workloads.

Google Cloud Platform (GCP)

- Market Share: 13%

- Strengths: AI/ML leadership, ultra-low latency compute (C3, C4)

- Compliance: Encryption by default, EU GDPR-ready, ISO standards

- Use Cases: High-frequency trading (HFT), predictive analytics, underwriting automation

Despite being third in market share, GCP is first in latency and innovation. Firms like 28Stone are leveraging GCP’s sub-2 microsecond tick-to-trade speeds for high-frequency trading—a feat once only possible with proprietary, on-prem hardware.

Best DevOps and Software Engineering Companies in FinTech

Let’s take a closer look at other top-tier engineering providers shaping the future of financial services.

Computools

- Notable for rebuilding legacy systems and implementing Visa-based microservices

- Helped Caribbean Bank achieve PCI DSS compliance and a 12% market share increase among Gen Z users

- Delivers holistic solutions from CX/UX to MLOps

ScienceSoft

- Founded in 1989, with 36 years in enterprise IT and banking infrastructure

- Uses KPIs like Cyclomatic Complexity and Maintainability Index to enforce code quality

- Clients include RBC Royal Bank, maintaining ISO 9001 & 27001 standards

GFT Technologies

- Banking-first firm turning cloud into an AI engine

- Developed Wynxx, a platform for faster DevOps delivery

- Helped Deutsche Bank modernize credit risk infrastructure globally

DataArt

- AWS-focused, specializing in “Cloud Enablement”

- Migrated GuestMetrics to AWS with zero downtime, reducing processing time

- Leverages AWS Well-Architected Framework for optimization

Zymr

- Silicon Valley-based, operating over 10,000 production containers

- Known for reducing release cycles by 40%

- Follows a “Compliance & Security First” DevOps model for lending and mobile banking apps

Gart vs. Traditional MSPs: A Comparison

While many FinTechs turn to Managed Service Providers (MSPs) for support, not all MSPs are created equal. Traditional MSPs focus on uptime and basic IT hygiene. But FinTech demands more — real-time responsiveness, cost agility, and deep cloud-native expertise.

Here’s how Gart Solutions compares:

| Feature | Gart Solutions | Red River | Ntiva |

|---|---|---|---|

| Cloud Specialization | AWS, Azure, GCP (Multi-cloud) | Azure-first | Generalist (SMB cloud services) |

| DevOps Expertise | Deep DevOps/SRE focus | Limited | Basic automation tools |

| Cost Optimization | Azure Spot VMs, autoscaling | Not core focus | Moderate |

| Security & Compliance | Built-in CI/CD compliance | Federal system-ready | HIPAA/PCI for SMBs |

| FinTech Case Studies | Multiple proven projects | Enterprise-heavy focus | Few industry-specific projects |

Traditional MSPs serve a purpose.

But as Fedir Kompaniiets puts it: “If you’re moving money or handling financial data, a generic IT playbook won’t cut it.”

“If you’re moving money or handling financial data, a generic IT playbook won’t cut it.”

Gart doesn’t just keep the lights on — it helps FinTechs engineer for the next horizon.

Gart’s Platform Engineering Philosophy

Where many providers stop at infrastructure, Gart takes it further with Platform Engineering — a structured approach that brings:

- Observability-as-code

- Auto-scaling pipelines

- Continuous resilience testing

- CI/CD pipelines with built-in compliance gates

The result? A system that not only scales, but adapts and heals itself.

“DevOps isn’t about deploying code faster. It’s about making sure the system is still smiling when your user base 10x’s overnight,” says Fedir Kompaniiets.

Whether it’s Terraform automation, Kubernetes Helm chart optimization, or on-demand staging environments, Gart brings Silicon Valley-level discipline to clients across Europe, MENA, and the U.S.

Security in FinTech: DevSecOps and the New Normal

With cybercrime damages projected to hit $10.5 trillion by 2025, security is no longer a bolt-on — it’s embedded at the heart of every FinTech architecture.

Modern FinTech DevOps pipelines are adopting:

- Policy-as-Code: CI/CD pipelines that check for compliance violations before merge

- Software Composition Analysis (SCA): Constant scanning of open-source dependencies

- Zero Trust Models: No implicit trust; every access requires continual validation

- Automated Fraud Detection: AI-powered anomaly detection baked into infrastructure

Gart engineers use tools like OPA (Open Policy Agent) and Checkov to ensure every change is safe, compliant, and trackable. The result is fewer outages, faster audits, and peace of mind for CTOs.

The Regulatory Environment: GENIUS Act, EU AI Law, and Beyond

The GENIUS Act (2025) introduced strict reserve and AML requirements for stablecoins. The EU AI Act is rolling out fines for unexplainable AI decisions. Together, these regulatory waves mean one thing:

Infrastructure must be “compliance-aware” by design.

Gart Solutions builds pipelines that:

- Automatically tag workloads by data classification

- Trigger audit logging for sensitive environments

- Support “explainability” layers for AI models

By proactively baking in legal guardrails, Gart ensures FinTechs stay ahead of both innovation and regulation.

The AIOps Transition in FinTech

The future of DevOps in FinTech lies in AIOps — using machine learning to improve everything from incident resolution to infrastructure optimization.

A few real-world examples:

- Azure OpenAI Service used by FinTechs like Crediclub to audit sales calls, reducing manual review costs by 96%

- Predictive scaling of services based on historical traffic patterns

- Auto-remediation for failed deployments or threshold breaches

Gart is already deploying agentic AI pipelines for FinTech clients — where the AI not only spots problems but takes corrective action autonomously.

“Humans shouldn’t need to babysit infrastructure,” Kompaniiets remarks.

“That’s what AI is for.”

Conclusion

The FinTech infrastructure world is moving fast. But speed without direction leads nowhere. The winners in 2026 and beyond will be companies that can build fast, operate securely, and scale intelligently. From boutique disruptors like Gart Solutions to cloud giants like AWS, the ecosystem is evolving to support this new era of cloud-native, AI-integrated, and compliance-first financial technology.

Whether you’re an early-stage startup or a legacy institution, the message is clear: Build for resilience. Engineer for scale. Partner with purpose.

And if you’re looking for a partner that lives and breathes that ethos — Gart Solutions is ready when you are with its the services for fintech.