The financial technology industry, commonly known as FinTech, has experienced a rapid and transformative evolution in recent years, redefining the way we interact with and manage our finances. At the heart of this revolution lies cloud computing, a technology that plays an indispensable role in shaping the future of financial services.

In this article, we will explore the critical role that cloud services play in the FinTech sector.

How to Choose the Right Cloud Services Provider for Your FinTech Company: a Step-by-Step Guide

Selecting the ideal cloud services provider for your FinTech venture is a critical decision that requires careful consideration. Here’s a step-by-step guide to help you make the right choice:

1. Define Your Requirements:

- Start by listing your specific needs, such as compliance standards (PCI DSS, GDPR), data security, scalability, and performance.

- Identify the technologies and services your FinTech business requires, like data analytics, blockchain, or machine learning.

2. Regulatory Compliance Assessment:

- Assess the regulatory requirements pertinent to the financial industry in your target markets.

- Ensure the cloud provider has a track record of complying with these regulations or offers specific solutions for compliance.

3. Security and Privacy Evaluation:

- Examine the cloud provider’s security measures, including encryption, access controls, and data protection.

- Review the provider’s history of security breaches and their incident response procedures.

4. Scalability and Performance Testing:

- Test the cloud provider’s scalability by simulating high-demand scenarios.

- Evaluate the provider’s performance in handling financial data, transactions, and real-time processing.

5. Cost Analysis:

- Develop a comprehensive understanding of the provider’s pricing model, including upfront and ongoing costs.

- Compare costs with the services and performance levels you need.

6. Service Level Agreements (SLAs):

- Carefully review SLAs to ensure they align with your business’s uptime and service level requirements.

- Look for guarantees related to performance, availability, and support response times.

7. Data Analytics Capabilities:

- Analyze the cloud provider’s data analytics tools and capabilities.

- Consider whether these tools can help you derive insights from your financial data.

8. Support and Services:

- Assess the provider’s support offerings, including onboarding, technical assistance, and maintenance services.

- Verify the availability of dedicated account managers and support channels.

9. Ecosystem and Integrations:

- Explore the provider’s ecosystem of partners and integrations.

- Determine if it aligns with the third-party services and tools you plan to use.

10. Innovation and Future-Readiness:

- Investigate the provider’s commitment to research and development.

- Ensure they keep up with emerging technologies relevant to the FinTech industry.

11. Customer Feedback and References:

- Seek feedback from other FinTech companies using the same cloud provider.

- Request references and case studies to gauge the provider’s reputation and reliability.

12. Multiple Cloud Providers (Optional):

- Consider adopting a multi-cloud strategy to leverage the strengths of different providers for various aspects of your business.

13. Consult with Experts:

If necessary, consult with cloud experts to make an informed decision.

14. Make Your Choice:

Based on the information gathered and your assessment of the cloud providers, make an informed choice that aligns with your FinTech company’s vision and goals.

15. Plan the Migration:

If you’re migrating from an existing infrastructure, develop a detailed migration plan to ensure a smooth transition to the chosen cloud provider.

Choosing the right cloud services provider for your FinTech company requires time, research, and due diligence. By following these steps, you can make a well-informed decision that will support the growth and success of your business in the dynamic world of financial technology.

💡If you’re considering migrating your FinTech project to another cloud or making the leap from on-premises to the cloud, Gart is here to help you navigate this transformation seamlessly.

Our experienced team specializes in cloud migration solutions tailored to your unique needs. Contact us today to embark on a successful journey towards the future of your FinTech venture!

💡 Contact Gart Today!

Best Cloud Services Providers for Fintech Company

Selecting a cloud services provider for your FinTech company is a crucial decision, and the choice should align with your specific needs and priorities. Here are a few reputable cloud providers often favored by FinTech companies:

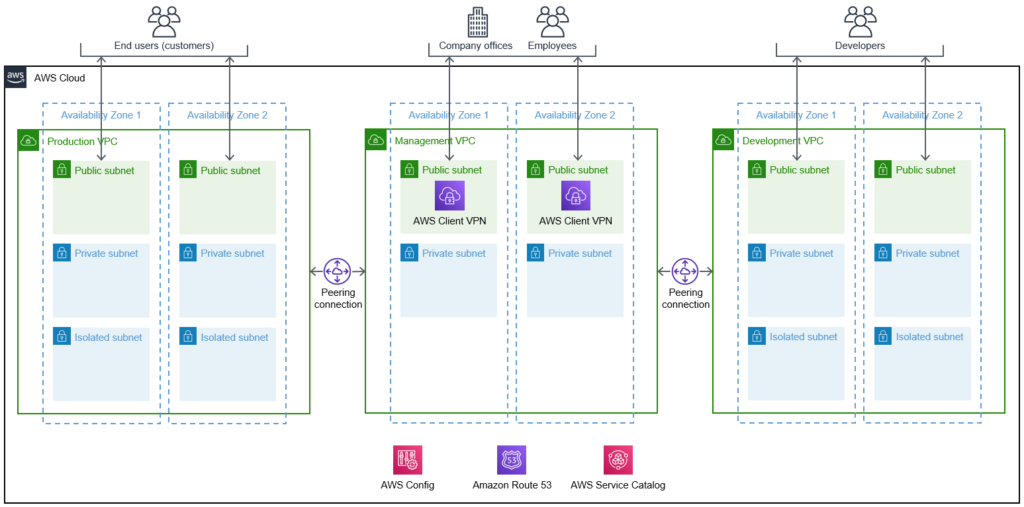

Amazon Web Services (AWS)

- Strengths: AWS is known for its extensive range of services, strong security features, and global data center presence. It offers services tailored to financial institutions’ regulatory compliance needs.

- Notable Users: Coinbase, Robinhood, Stripe.

- Read more: AWS Migration Services

Microsoft Azure

- Strengths: Azure provides robust security and compliance tools, making it a suitable choice for financial services. Its integration with Microsoft’s other products is also advantageous.

- Notable Users: Nasdaq, JPMorgan Chase, HSBC.

- Read more: Solutions for the financial services industry

Google Cloud Platform (GCP)

- Strengths: GCP is recognized for its data analytics and machine learning capabilities, which can be valuable for FinTech companies looking to derive insights from data.

- Notable Users: PayPal, Intuit, Betterment.

- Read more: Google Cloud for financial services

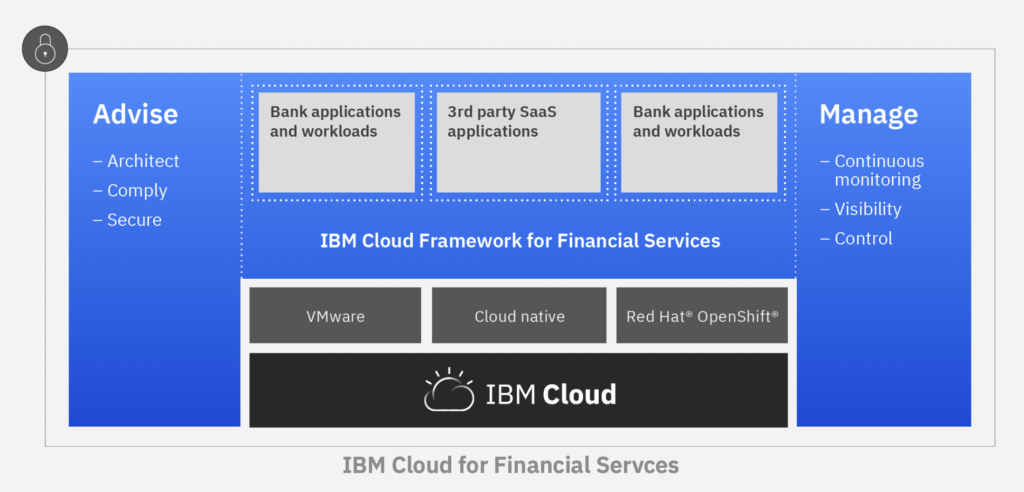

IBM Cloud

- Strengths: IBM Cloud offers blockchain and AI capabilities, which can be vital for FinTech innovation. It also emphasizes security and regulatory compliance.

- Notable Users: R3, Northern Trust, Saxo Bank.

- Read more: IBM Cloud for Financial Services

Oracle Cloud

- Strengths: Oracle Cloud is a solid choice for financial institutions looking for database solutions and comprehensive enterprise-grade applications.

- Notable Users: BBVA, SocGen, Mitsubishi UFJ Financial Group.

- Read more: Strands delivers fintech insights with Oracle Cloud

Alibaba Cloud

- Strengths: Alibaba Cloud is strong in the Asia-Pacific region and offers a wide range of services, making it suitable for global expansion.

- Notable Users: Ant Financial, Ping An, WeBank.

- Read more: FinTech on Alibaba Cloud

Ultimately, the best cloud services provider for your FinTech company depends on your unique business requirements, such as regulatory compliance, data analytics, scalability, and geographic presence. It’s recommended to conduct a thorough assessment and consider consulting with IT experts to determine which provider aligns best with your specific goals and needs. Additionally, many FinTech companies use a multi-cloud approach to leverage the strengths of multiple providers for various aspects of their business.

Read more: How FinTech Companies Unlock Benefits of DevOps

The Specific Requirements of the Financial Industry

The financial industry, with its unique and highly regulated nature, imposes distinct requirements on businesses operating within it. These specific requirements stem from the need to ensure the integrity, security, and stability of financial systems.

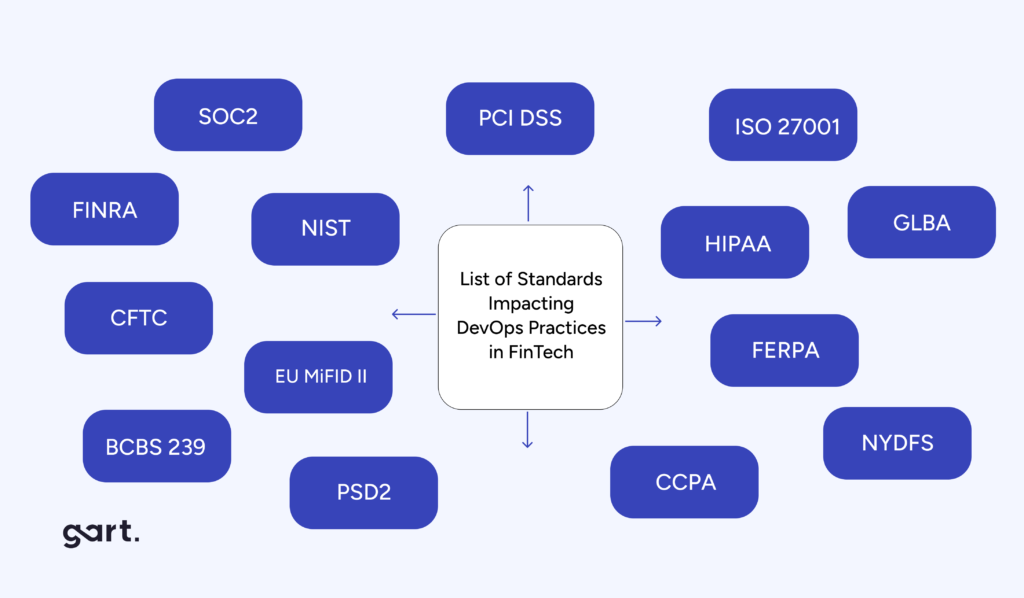

Stringent Regulatory Compliance

The financial industry is subject to a multitude of regulatory frameworks designed to safeguard investors, maintain market integrity, and prevent financial crises. These regulations include the Payment Card Industry Data Security Standard (PCI DSS), the General Data Protection Regulation (GDPR), the Dodd-Frank Wall Street Reform and Consumer Protection Act, and many others. FinTech companies must adhere to these regulations, necessitating robust data security and privacy measures.

Performance and Scalability

As financial operations generate enormous amounts of data, systems must provide high-performance data processing and analytics capabilities. Additionally, FinTech companies often experience rapid growth, requiring cloud infrastructure that can scale to accommodate increased demand without performance degradation.

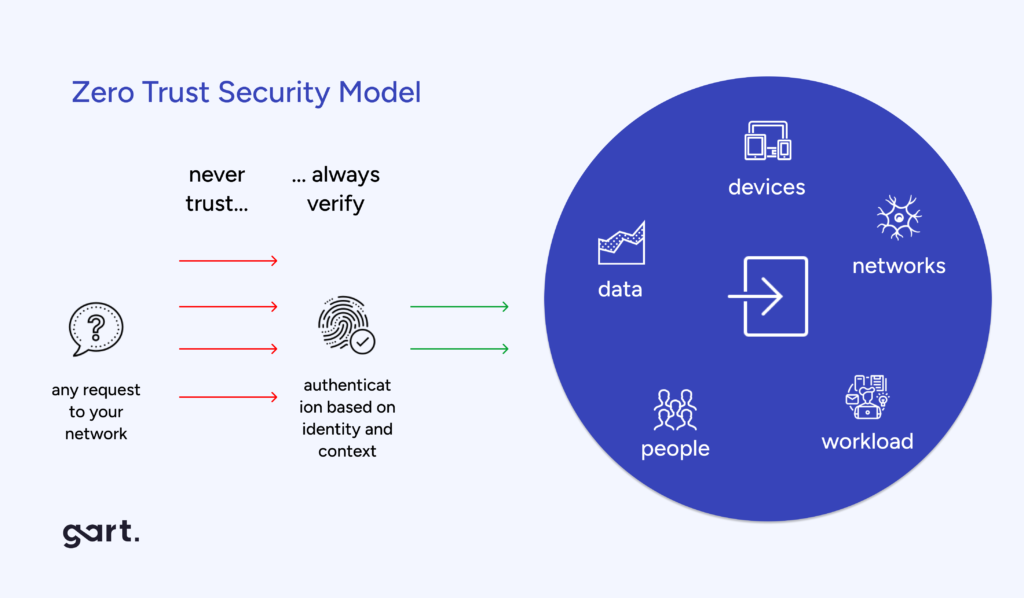

Data Security and Privacy

The handling of sensitive financial data requires the highest level of security and privacy. Financial institutions and FinTech companies must implement advanced encryption techniques, access controls, and authentication methods to protect customer data. The threat of data breaches and cyberattacks is an ever-present concern, making security paramount.

Low Latency

In the world of high-frequency trading and real-time financial decision-making, low-latency data access and processing are crucial. Any delay in data transmission can result in lost opportunities and financial setbacks.

Comprehensive Compliance Reporting

Financial institutions and FinTech companies are obliged to provide extensive compliance reporting, often involving complex audits and documentation. Cloud services should offer tools and features that facilitate compliance reporting, saving time and effort.

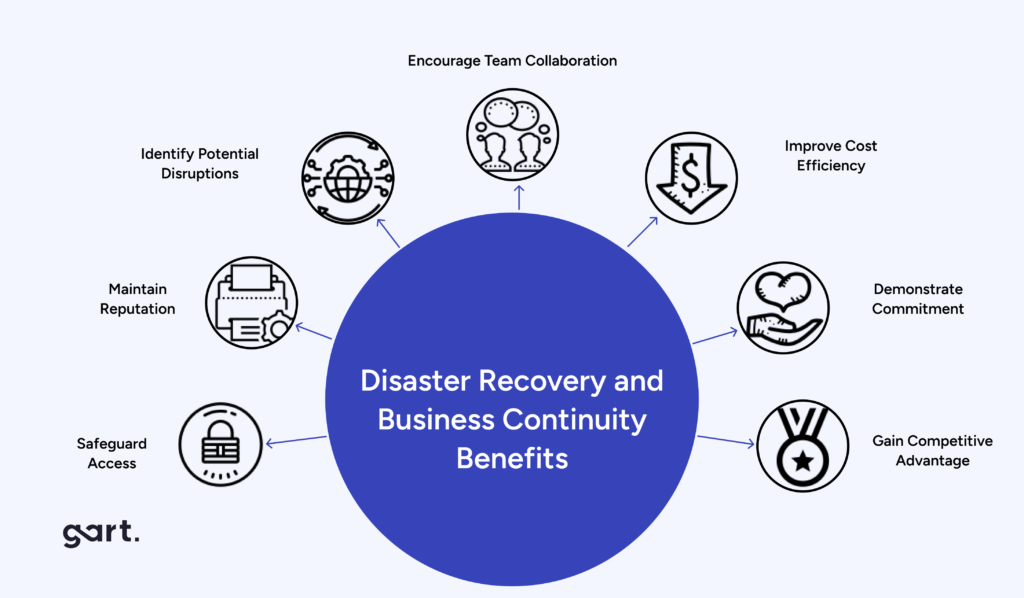

Disaster Recovery and Business Continuity

The financial sector mandates robust disaster recovery plans. Cloud providers must ensure data redundancy, failover mechanisms, and swift recovery procedures in the event of unforeseen disruptions.

High Availability and Reliability

In the financial industry, even a momentary system outage can result in substantial financial losses and reputational damage. Systems must be available 24/7, and downtime is generally not tolerated. Cloud providers need to offer high availability, redundancy, and robust disaster recovery solutions to meet these demands.

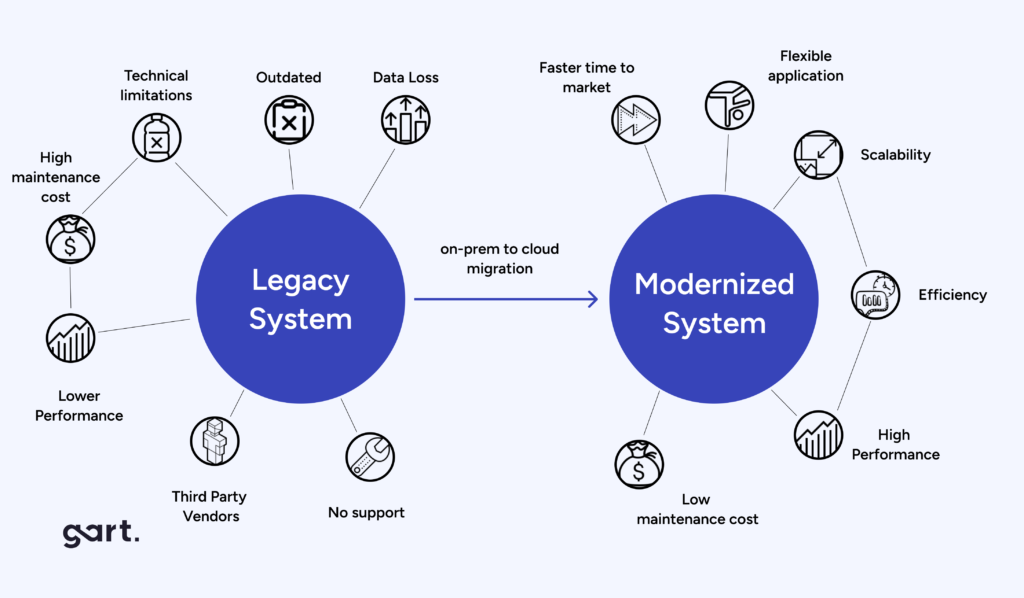

Integration with Legacy Systems

Many financial organizations rely on legacy systems. Cloud services must seamlessly integrate with these existing systems, enabling a smooth transition to modernized infrastructure.

In conclusion, the financial industry’s specific requirements are driven by a necessity to maintain trust, security, and compliance while adapting to rapidly evolving technologies. Meeting these demands is critical for FinTech companies and financial institutions, and the choice of a cloud services provider plays a pivotal role in ensuring that these requirements are met effectively and efficiently.

Case Study: Migration from On-Premise to AWS for a Financial Company

Our client, a prominent financial company with over two decades of experience in the payment industry, offers a wide range of services, including banking processing, card product launches, and payment acceptance solutions.

The client sought Gart’s expertise to migrate its Visa Mastercard processing application from on-premise infrastructure to the AWS cloud.

Gart devised a comprehensive migration plan, comprising the following phases:

1. Assessment: In this phase, we inventoried the client’s systems and planned the migration to AWS. This included creating a business case, evaluating readiness for the cloud, and leveraging the AWS Migration Acceleration Program (MAP) for cost savings.

2. Lift & Shift: We fulfilled the client’s request for a “as is” migration, seamlessly transferring their application and data to AWS without redesign.

Results: The shift to AWS offered:

- Cost Savings: Through AWS’s pay-as-you-go model, upfront investments were eliminated, potentially leading to long-term savings.

- Scalability and Flexibility: AWS’s elastic infrastructure ensured smooth operations during peak times.

- Enhanced Performance: The global data center network improved application performance.

- Security and Compliance: Robust security and compliance with industry standards were ensured.

- Reliability and High Availability: AWS’s high availability minimized downtime.

- Global Reach: Expansion to new markets was made effortless.

- Automated Backups and Disaster Recovery: Data loss was minimized with automated backup and recovery.

This migration optimized operations, cut costs, and set the stage for FinTech growth and innovation.

Conclusion

In conclusion, the critical role of cloud services in FinTech cannot be overstated. The cloud provides the infrastructure, tools, and agility that FinTech companies need to innovate, scale, and stay secure in an ever-evolving industry. As FinTech continues to reshape the financial landscape, the cloud will remain a foundational element driving this transformation. It is the technological backbone upon which the future of finance is being built, offering new possibilities for companies and consumers alike.

Moreover, it’s worth noting that if you are considering migrating your FinTech application to any cloud provider of your choice, GART is here to assist. With our expertise in cloud migration, we are more than willing to help make your transition seamless and efficient. Your chosen cloud provider can be easily integrated with the comprehensive support and services we offer, ensuring your FinTech venture remains at the forefront of innovation and reliability in the dynamic world of finance. See our profile on DesignRush

See how we can help to overcome your challenges