FinTech companies are at the forefront of innovation, offering cutting-edge solutions that reshape the way we interact with money. To remain competitive in this dynamic industry, these companies are increasingly turning to DevOps as a strategic approach to software development and IT operations.

DevOps not only accelerates the delivery of financial services but also enhances security, compliance, and customer experience. In this article, we will explore how FinTech companies unlock the manifold benefits of DevOps and why it has become a game-changer for the industry.

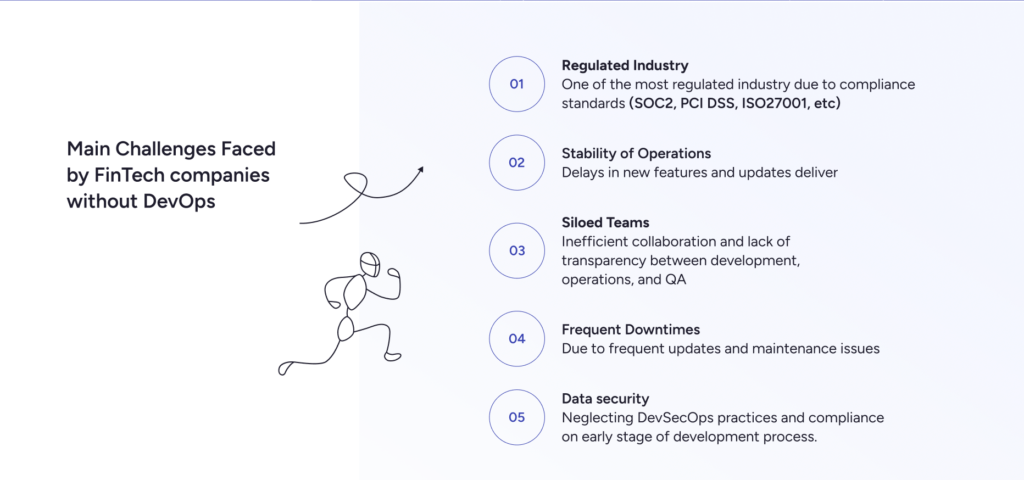

Main Challenges Faced by FinTech Companies

Stability of Operations & Constant Availability

The cloud infrastructure managed by code eliminates the possibility of manual iterative tweaks and configuration drifts.

Ansible and Jenkins DevOps tools enable to create pipelines that automate every action – from coding to preparing test environments, testing code and packaging it for release, updating production servers without disruptions.

Regulated Industry

Fintech is one of the most regulated due to compliance concerns.

DevOps principles such as Continuous Integration (CI), Continuous Deployment (CD) and provisioning the immutable Infrastructure as Code (IaC) result in automated software lifecycle pipelines with no room for human error or malicious intent.

Conservative Approaches

Fintech has always been the most conservative in terms of infrastructure management.

DevOps approach allows financial institutions to securely leverage rapidly growing technologies, such as blockchain and AI, and keeps up with existing Fintech industry trends.

Specific DevOps Considerations for the FinTech Industry

DevOps practices in the FinTech industry require a heightened focus on security, compliance, and customer trust due to the sensitive nature of financial data and the ever-evolving regulatory landscape. Here are some specific considerations for DevOps in the FinTech sector:

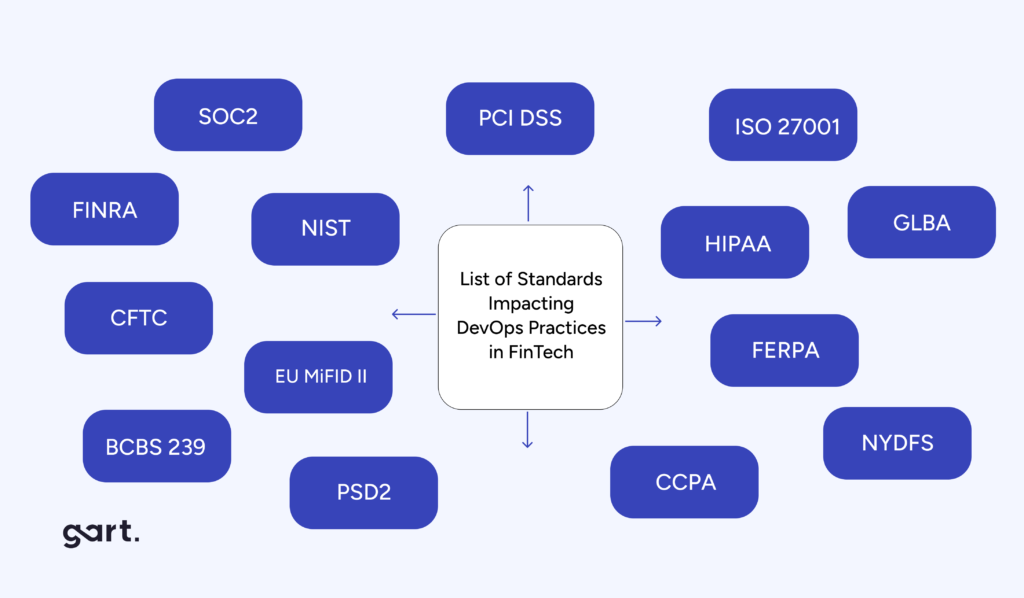

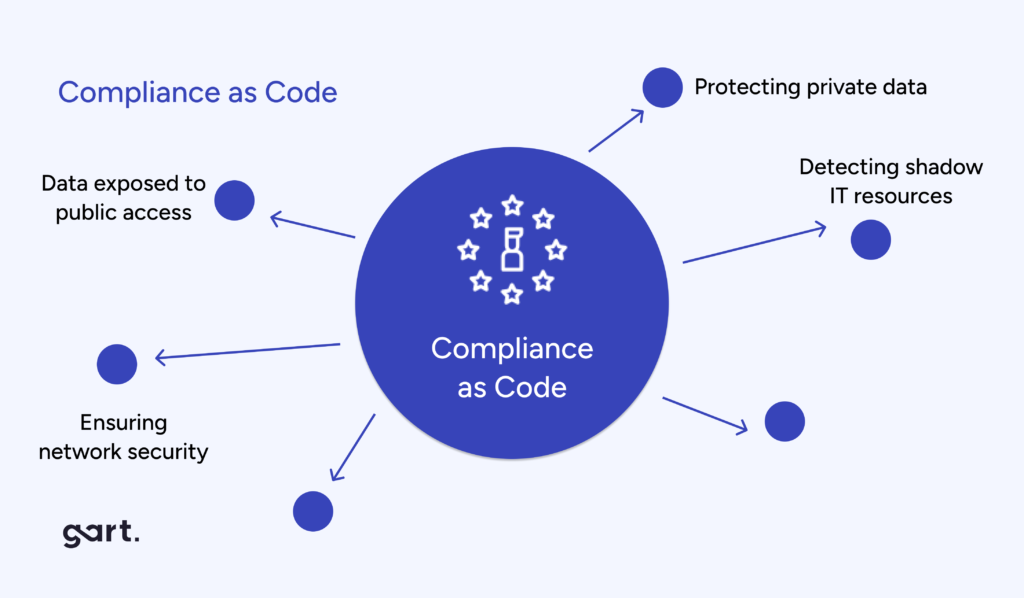

Compliance as Code

The FinTech industry is indeed one of the most regulated sectors, and adhering to various compliance standards is essential. There are here lots of standards that can significantly impact DevOps practices in the FinTech industry:

SOC2 (Service Organization Control 2) is an auditing and reporting framework designed for service organizations, including those in the FinTech industry, to assess and demonstrate the security, availability, processing integrity, confidentiality, and privacy of customer data.

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to safeguard credit card data and prevent fraud. It applies to any organization that processes, stores, or transmits cardholder data, making it highly relevant to FinTech companies involved in payment processing.

ISO 27001 (International Organization for Standardization 27001) is an internationally recognized information security management system (ISMS) standard. It provides a systematic approach for managing information security risks and ensuring the confidentiality, integrity, and availability of sensitive information.

For FinTech companies, regulatory compliance is non-negotiable. To streamline compliance efforts, implement “Compliance as Code” by integrating regulatory requirements directly into your code and automation processes. This ensures that compliance is built into your software from the ground up, reducing the risk of costly violations.

Regulatory Compliance Automation

FinTech companies operate in a heavily regulated environment. Automate compliance checks, documentation, and reporting to ensure that your DevOps processes align with financial regulations. This helps in maintaining audit trails and ensures that your organization is always compliant.

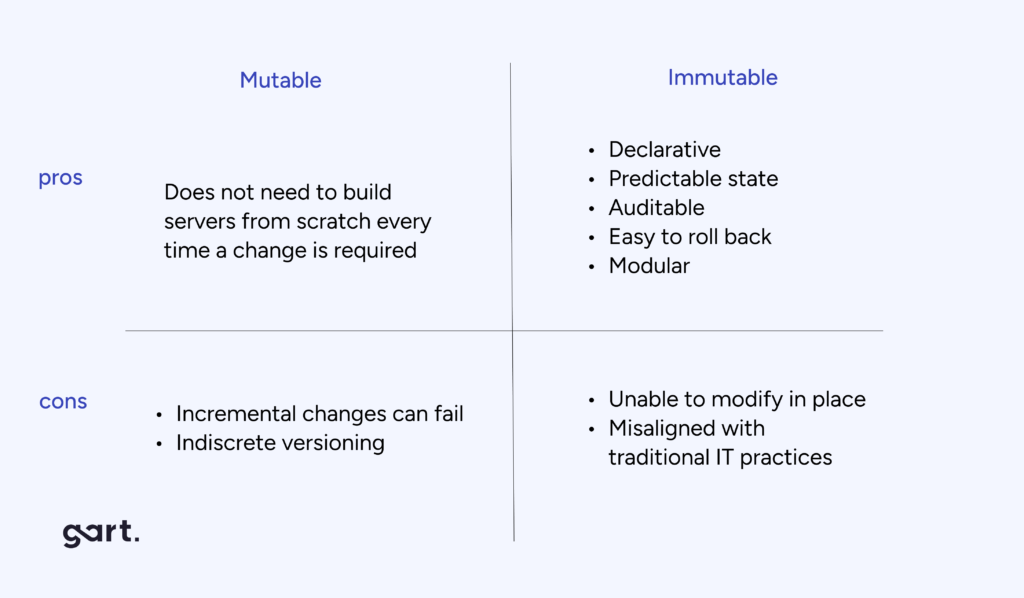

Immutable Infrastructure for Security

Embrace the concept of immutable infrastructure, where servers and environments are treated as disposable entities that can be easily recreated. This reduces the risk of configuration drift and makes it simpler to maintain a secure and consistent environment.

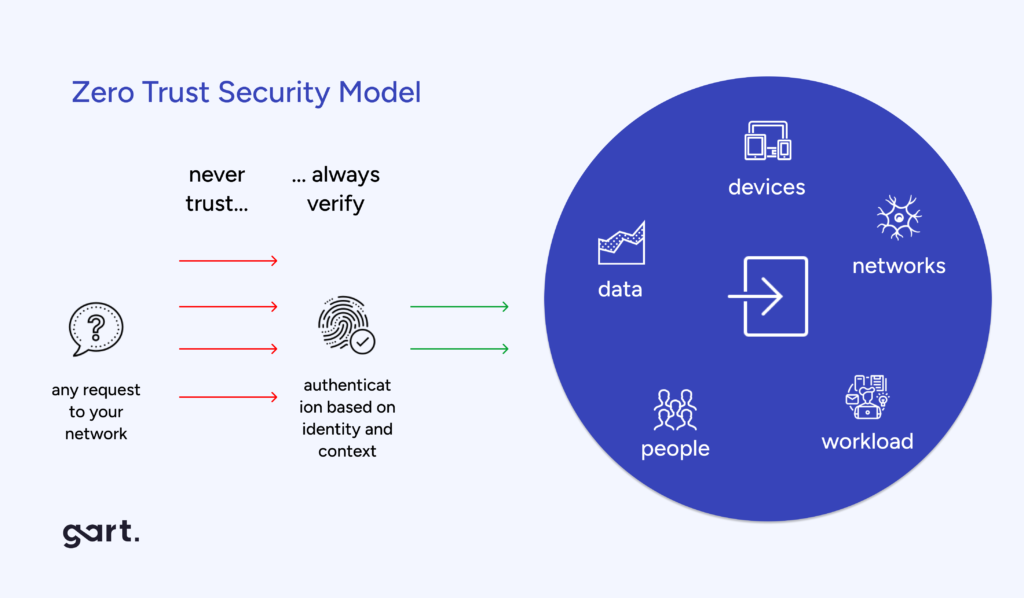

Zero Trust Security Model

Adhere to a “Zero Trust” security model, which assumes that threats can exist both outside and inside your network. Implement stringent access controls, multi-factor authentication, and micro-segmentation to protect sensitive financial data and critical systems.

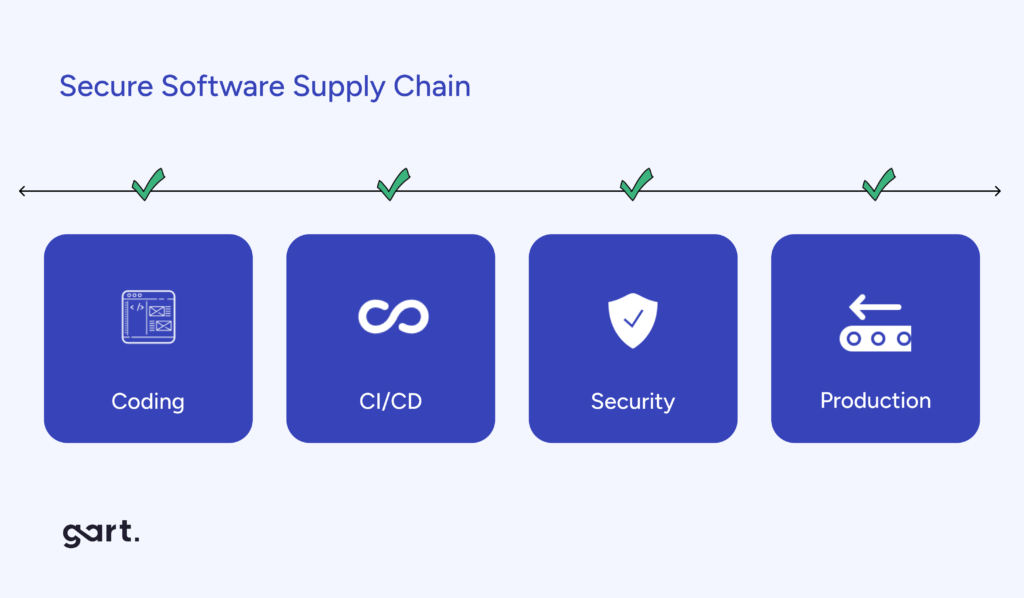

Secure Software Supply Chain

In the FinTech industry, securing the software supply chain is paramount. Ensure that your DevOps pipeline is secure from end to end, including third-party dependencies, and utilize automated scanning and verification tools to prevent the introduction of malicious code.

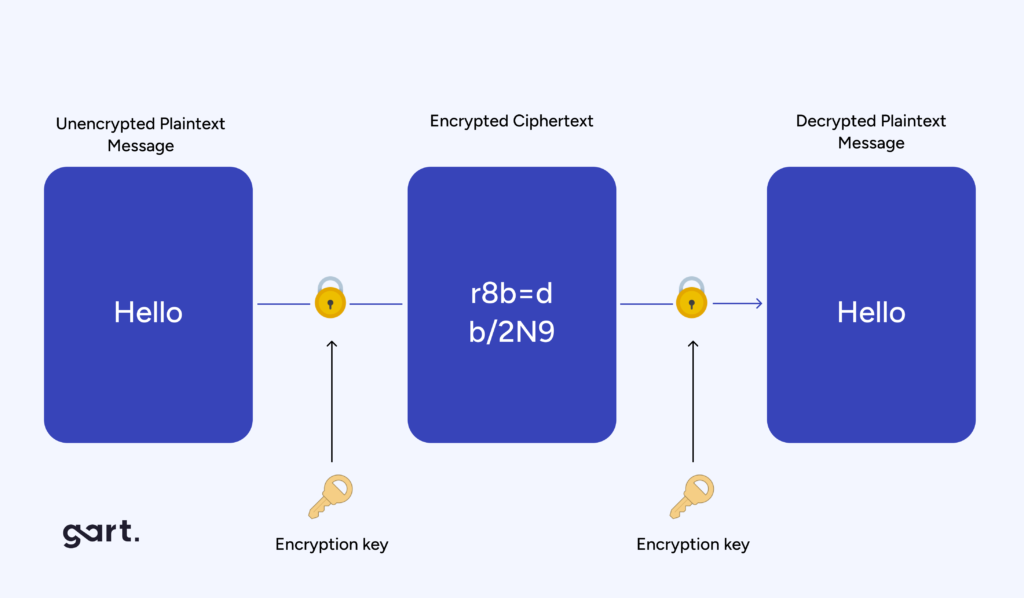

Financial Data Encryption

Encrypt financial data both in transit and at rest. Utilize strong encryption algorithms and enforce encryption protocols to protect sensitive information, ensuring it remains confidential and secure.

Patch Management

Develop a robust patch management strategy to address vulnerabilities promptly and in compliance with industry regulations. Automated patch management can help keep your systems up-to-date and secure.

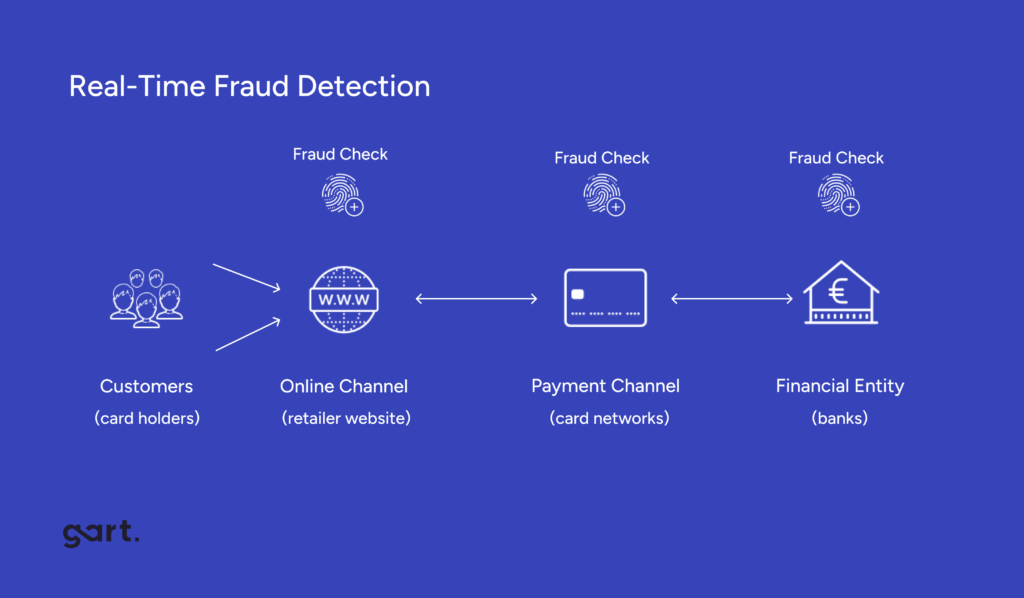

Real-Time Fraud Detection

Implement real-time fraud detection and prevention mechanisms within your DevOps pipeline. Utilize machine learning and AI to detect suspicious financial activities as they occur, helping prevent fraud in real-time.

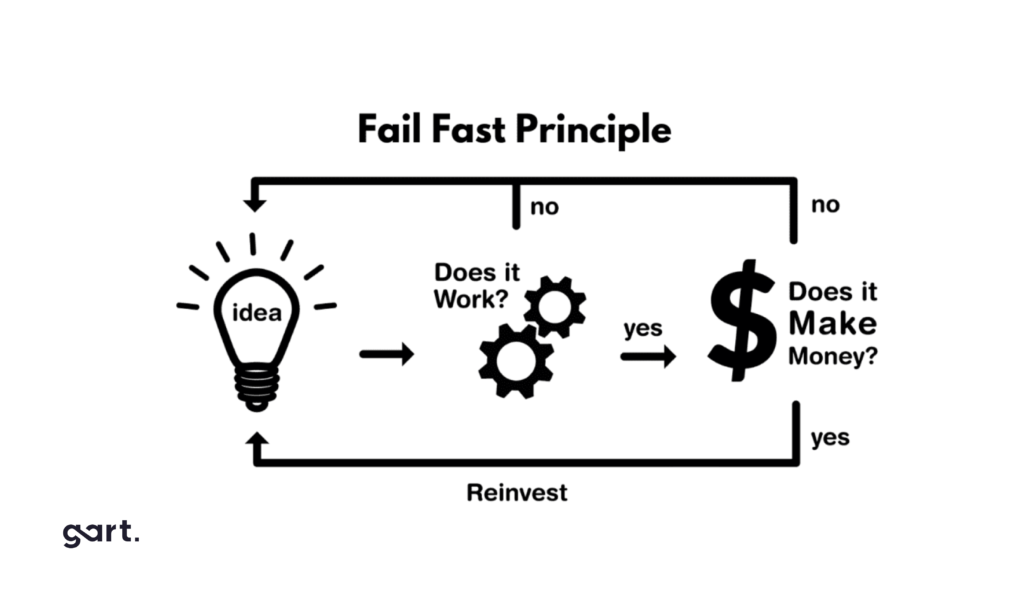

Fail Fast, Learn Faster

Embrace a culture of experimentation and learning. Encourage teams to take calculated risks, with the understanding that failures are opportunities for improvement. Post-mortems and retrospectives are essential for continuous learning and enhancement of processes.

Top 10 DevOps Practices for FinTech

Below are some of the key DevOps best practices specifically tailored for the FinTech sector:

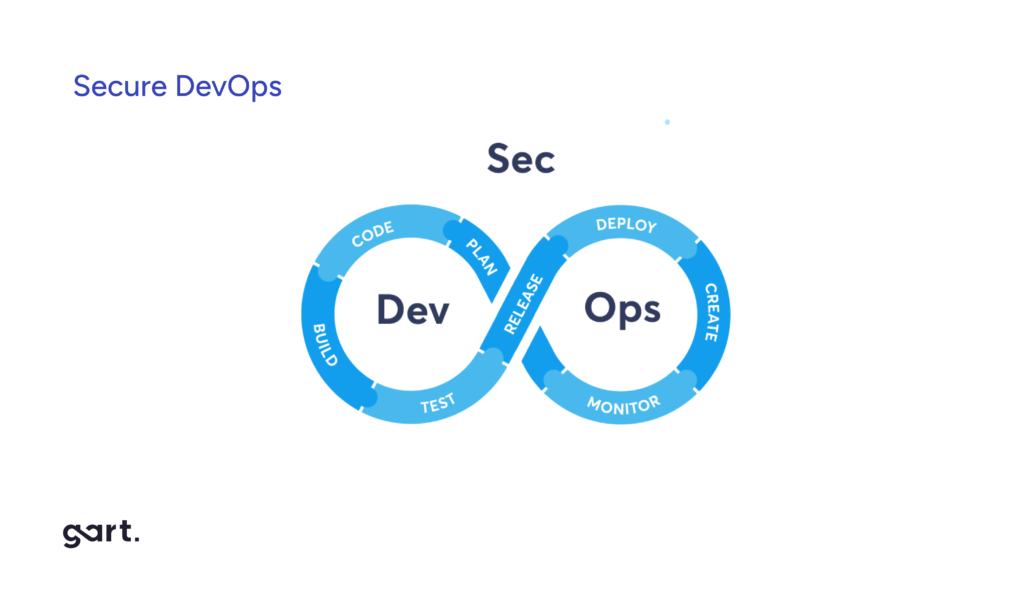

Best DevOps Practice #1: Secure DevOps

DevSecOps is aimed at infusing automated security best practices at every stage of the SDLC.

Embed security practices into your DevOps pipeline. Employ tools and techniques for automated security testing, vulnerability scanning, and code analysis. Regularly update dependencies to patch vulnerabilities and adhere to security protocols at every stage of development and deployment.

Best DevOps Practice #2: CI/CD for financial institutions

Implement CI/CD pipelines to automate the build, test, and deployment processes. This accelerates development and reduces the chance of errors in the production environment. Frequent deployments also make it easier to implement necessary updates and security patches promptly.

The adoption of Continuous Integration (CI) and Continuous Delivery (CD) for FinTech and financial institutions promising swifter, more stable, and highly predictable code deployments.

- Faster Time to Market

Embracing automation paves the way for rapid code deployment into production, free from any service interruptions.

- Agility and Responsiveness

CI/CD empowers you to build and test swiftly within a secure sandbox environment.

It enables your teams to experiment, detect and resolve bugs and integration challenges promptly, ensuring the release of fully refined and functional software.

- Increased Productivity

Implementing CI/CD allows the development team to stay more productive.

CI/CD for FinTech eliminates rework and wait time. By automating routine processes, developers can focus on other more crucial tasks, such as code quality or security.

- Superior Product Quality

CI/CD’s seamless automation guarantees heightened reliability, early error detection and meticulous risk assessment, enhancing the overall quality of the end product.

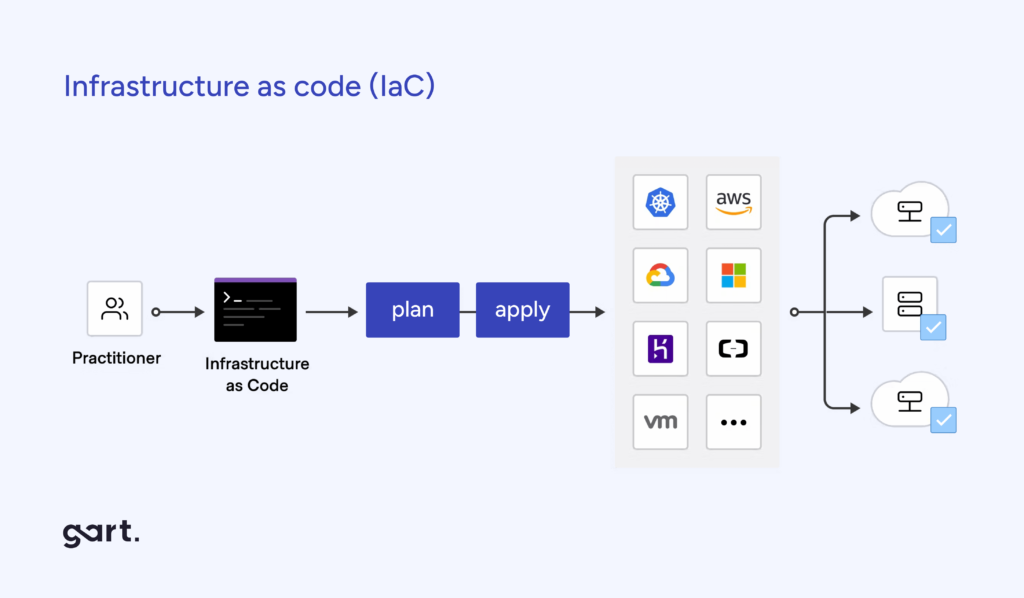

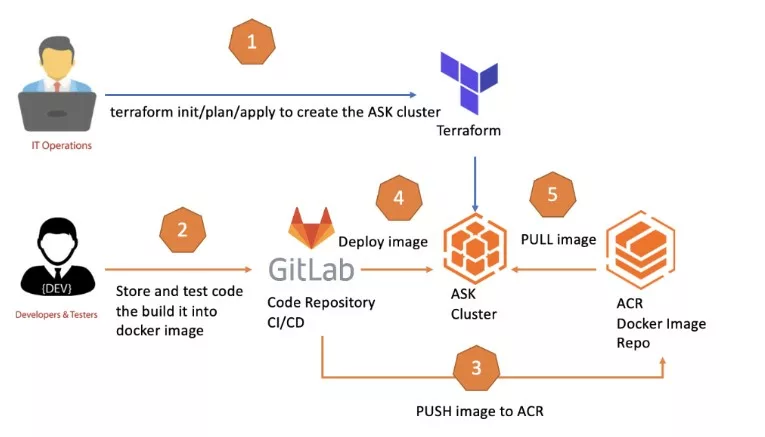

Best DevOps Practice #3: Infrastructure as code (IaC)

Instead of programming configurations manually, testing and deploying – with IaC your teams can build up the environment you need to develop and test new products in one click and with less risk.

Treat infrastructure components as code, allowing for automated provisioning, configuration, and management of resources. This approach ensures consistency across environments and facilitates disaster recovery and scalability.

Benefits of IaC for financial application development:

- Faster development and deployment

IaC accelerates team performance at every stage of the SDLC. Provision CI/CD and testing environments in moments and streamline deployments as the application and production infrastructure are packed into one unit.

- Consistent product quality

No manual infrastructure provisions – no security vulnerabilities and non-compliance — the least desirable scenarios for finance.

- Enhanced testing

Test applications in a production-like environment at any stage of the SDLC — prevent common deployment issues caused by configuration drift, missing dependencies, or integrations.

- Cost optimization

IaC helps optimize cloud computing bills through targeted optimization, dynamic provisioning and teardown of environments.

Best DevOps Practice #4: Collaboration and Communication

Foster a culture of collaboration and open communication between development, operations, and security teams. Promote transparency and the sharing of knowledge to enhance the overall effectiveness of DevOps practices.

Best DevOps Practice #5: Capacity Planning and Scalability

Regularly assess your infrastructure’s capacity and performance. Use metrics and historical data to plan for scalability, ensuring that your FinTech services can handle increased loads and remain highly available.

Best DevOps Practice #6: Backup and Disaster Recovery

Develop robust backup and disaster recovery plans to safeguard against data loss and ensure business continuity in the event of unforeseen disruptions.

Regularly test your disaster recovery plans to guarantee that, in the event of a major disruption, you can swiftly recover and maintain financial operations. DevOps should facilitate automated failover and rapid recovery processes.

Best DevOps Practice #7: Redundancy and High Availability

Design your DevOps infrastructure for redundancy and high availability. FinTech services must be accessible 24/7. Implement automated failover mechanisms and data replication to ensure minimal downtime and data loss in case of system failures.

Best DevOps Practice #8: Threat Intelligence Integration

Integrate threat intelligence feeds and monitoring into your DevOps pipeline to stay ahead of potential security threats. This proactive approach helps in identifying and mitigating emerging risks.

Best DevOps Practice #9: Comprehensive Audit Trails

Maintain comprehensive audit trails of all changes made in your DevOps pipeline. This is vital for tracking any unauthorized modifications and for meeting regulatory compliance requirements.

Best DevOps Practice #10: Data Privacy and GDPR Compliance

If your FinTech company operates in regions subject to the General Data Protection Regulation (GDPR), ensure that your DevOps practices align with GDPR principles, including data protection impact assessments and data subject rights.

These best practices not only ensure the smooth operation of software development and deployment but also contribute to the overall success of FinTech companies. By following these DevOps best practices, FinTech companies can stay competitive, comply with stringent regulations, and provide secure, reliable, and innovative financial services to their customers. The seamless integration of DevOps into the FinTech ecosystem is a pivotal factor in achieving success in this rapidly evolving industry.

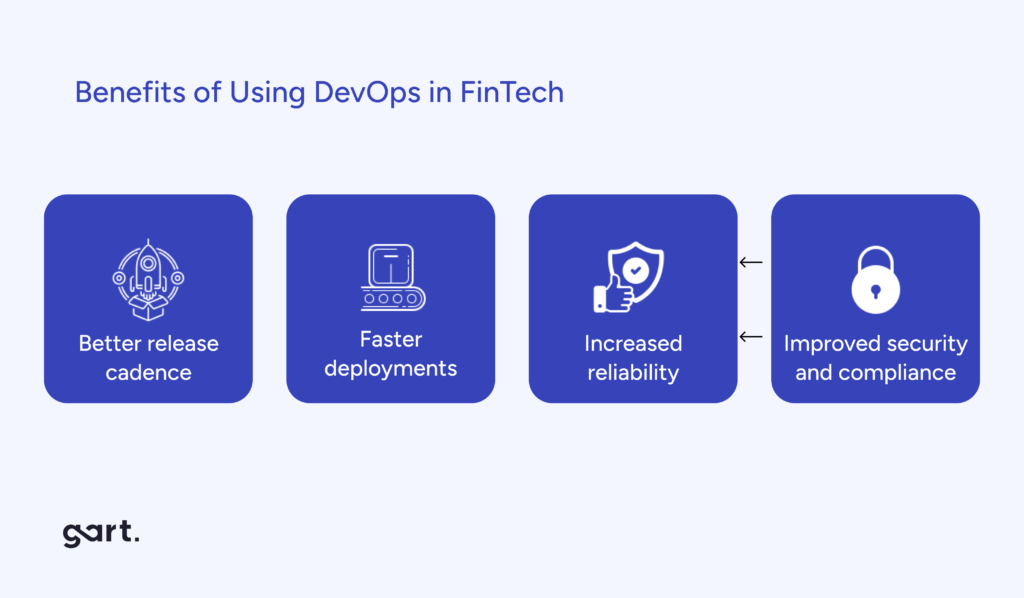

Benefits of Using DevOps in FinTech

Better release cadence

Top DevOps teams deploy new code 208 times more frequently than WHOM.

Faster deployments

The best teams deploy 973x more frequently and have lead times 6750x faster when compared to low performers.

DevOps practices enable FinTech companies to streamline and automate their software development and deployment pipelines. This, in turn, reduces time-to-market for new features and updates. In an industry where agility is key, this speed is a significant advantage, as it allows FinTech companies to respond swiftly to market changes and customer demands.

Increased reliability

Mature adopters have a 3X lower rate of failure.

The automated testing and continuous integration inherent in DevOps ensure that FinTech products and services are thoroughly checked for quality and reliability throughout the development process. With fewer bugs and issues, customers can trust in the consistency of services, promoting customer loyalty and satisfaction.

Improved security and compliance

High performers spend 50% less time fixing security issues compared to low performers thanks to better-documented development, testing processes, clear frameworks for application governance and security.

Security is paramount in the financial industry, and DevOps practices integrate security from the outset. By automating security testing and compliance checks, FinTech companies can detect and rectify vulnerabilities early in the development cycle, reducing the risk of data breaches and regulatory fines. This proactive approach is especially vital when handling sensitive financial information.

Case Studies of Adopting DevOps in the Financial Services Industry

Gart has completed several projects implementing DevOps for financial industry businesses.

Case 1: Consulting due to Migration from On-Premises to AWS for a Financial Company

The customer, a technology-driven company, that provided banking processing services and solutions for mobile banking required their Visa Mastercard processing application migration from On-Premises to the AWS cloud.

The client benefitted from significant cost savings through the AWS MAP program, which offered discounts on resource usage for up to three years, potentially reaching up to 70% in savings.

Case 2: Infrastructure Audit, Optimization, and CI/CD

One of the Gart customers lacked DevOps engineers, methodologies, and tools like IaC approaches and did not utilize the best DevOps practices to the full extent.

We entered the project by introducing improvements without re-building from scratch, as the client couldn’t afford to migrate the whole project to microservices and Kubernetes.

Among the solutions were improving the build process and reworking the IaC, which helped to optimize the infrastructure and revolutionize the delivery process.

When to Choose DevOps Outsourcing?

- You need a DevOps development team with unique skills, but you cannot select suitable candidates.

- You aim for shorter development cycles with better quality, less risk, and no additional costs.

- You are a startup that needs DevOps expertise, but has no need to hire full-time professional

- You want to offload some specialist.

The adoption of DevOps practices has become a strategic imperative for FinTech companies aiming to thrive in the digital age. Its ability to deliver speed, quality, security, and cost-efficiency has made DevOps a game-changer in the industry. As customer expectations and market dynamics continue to evolve, FinTech companies leveraging DevOps will be well-positioned to provide innovative, reliable, and secure financial services that cater to the needs of today’s digitally connected world.

See how we can help to overcome your challenges