Executive Summary

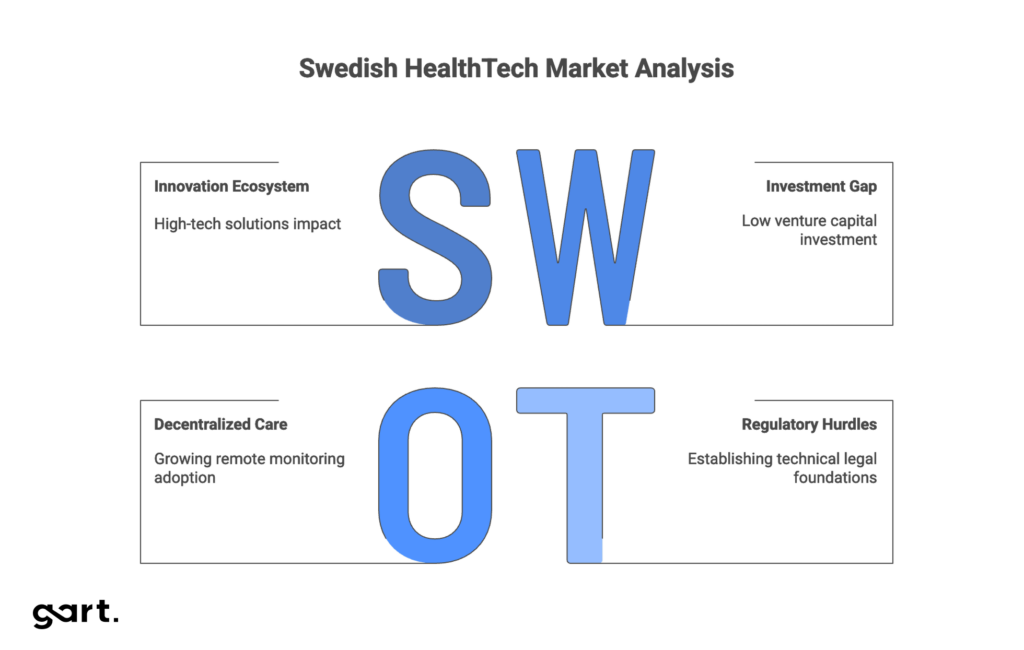

Sweden’s HealthTech sector stands at a crossroads. The country has bold ambitions, cutting-edge innovation, and substantial public investment—but faces significant infrastructure bottlenecks that threaten to derail its digital transformation goals.

The national “Vision for eHealth 2025” aims to position Sweden as the global leader in healthcare digitalization. Regions invest approximately $1.22 billion annually in IT infrastructure, and the Home Healthcare market is projected to reach $8.1 billion by 2030, growing at 10.3% CAGR. Swedish companies like Neko Health, Acorai, and AMRA Medical are pioneering advanced diagnostics and non-invasive monitoring worldwide.

Yet beneath this promising surface lies a uncomfortable reality: critical infrastructure projects are years behind schedule. The National Medication List (NLL), originally planned for 2022, won’t be fully implemented in some regions until 2028 or even 2030. The upcoming European Health Data Space (EHDS) regulation requires €150-400 million in investments by 2028 and demands a fundamental shift from Sweden’s traditional opt-in consent model to an EU-mandated opt-out approach.

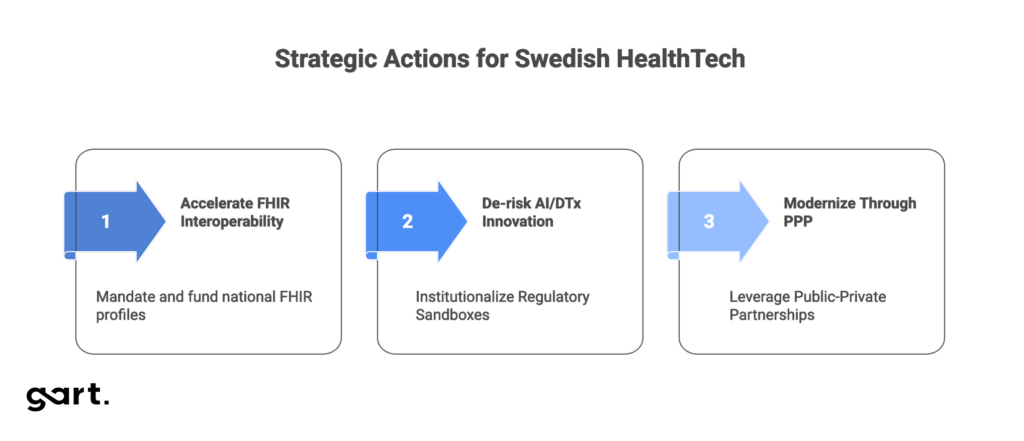

Three strategic actions:

- Accelerate FHIR Interoperability: Mandate and fund national FHIR profiles using EHDS implementation budgets to create a unified data exchange standard critical for scaling AI solutions.

- De-risk AI/DTx Innovation: Institutionalize Regulatory Sandboxes (IMY/RISE) to provide proactive legal guidance on complex technologies like federated learning, eliminating regulatory uncertainty.

- Modernize Through PPP: Leverage Public-Private Partnerships to systematically replace legacy EHR systems and ensure continuous technology refresh cycles.

Market Landscape and Growth Trajectory

Sweden operates a highly decentralized, tax-funded healthcare system (86% of total spending) managed by 21 regions. This structure creates consistent demand for technology solutions that address efficiency challenges and workforce shortages, particularly in specialized care.

The market shows a clear trajectory toward decentralized care. Home Healthcare revenues will reach $8.1 billion by 2030, growing at 10.3% annually from 2025-2030. While services represent the largest revenue segment, equipment is the most profitable and fastest-growing category—validating the rapid adoption of remote monitoring technologies essential for managing an aging population and reducing clinic burdens.

The government and Swedish Association of Local Authorities and Regions (SALAR) share an ambitious vision: by 2025, Sweden should be the world’s best at leveraging digitalization and eHealth opportunities to deliver equitable, high-quality healthcare and social services.

The eHealth Agency’s strategic framework distinguishes between actual eHealth usage (Area A) and the necessary preconditions (Area B)—regulatory frameworks, technical infrastructure, and standards. This distinction matters enormously.

2025 represents a powerful regulatory catalyst and consolidation moment, but not a deadline for full technological maturity. With key infrastructure projects like NLL delayed by years, the realistic priority for 2025 is establishing minimum viable technical and legal foundations (Area B) so further development (Area A) can proceed in a coordinated fashion afterward.

Despite venture capital investments in Swedish Life Science representing only 0.7% of total VC invested in 2024, global trends indicate growing confidence in European HealthTech innovation. Worldwide investment focus is shifting toward Provider Operations and AI-driven solutions that enable back-office automation and efficiency gains, with M&A activity dominated by Private Equity deals.

Sweden maintains strong innovation hubs supported by government structures. Vinnova, the Swedish Innovation Agency, funds and coordinates collaboration between academia, public organizations, and private business through programs like Medtech4Health. Companies such as Neko Health (diagnostics) and Acorai (cardiac monitoring) demonstrate that Sweden’s innovation ecosystem concentrates on high-tech solutions with direct clinical impact.

Regulatory Compliance

Sweden’s HealthTech regulatory environment is multilayered, encompassing EU-wide regulations and national legislation. Successfully navigating this landscape requires understanding how these levels interact.

GDPR and Patient Data Act

The foundation is the General Data Protection Regulation (GDPR, Regulation EU 2016/679), which imposes particularly strict obligations on processing special categories of personal data, including medical data (Article 9).

At the national level, the Swedish Patient Data Act (Patientdatalagen, PDA, SFS 2008:355) is critical. This law ensures confidentiality and safe, efficient data use exclusively for purposes directly related to treatment, diagnosis, and care. PDA requires healthcare providers to obtain explicit patient consent before using or sharing their data, except in emergency situations. Additionally, PDA ensures high transparency: patients have the right to review access logs to their medical records—a powerful mechanism for preventing unauthorized access and building trust.

Medical device and software oversight is managed by the Swedish Medical Products Agency (Läkemedelsverket) for compliance with EU Medical Device Regulations (MDR and IVDR). The Health and Social Care Inspectorate (Inspektionen för vård och omsorg, IVO) additionally monitors clinical use of these devices.

The EHDS Impact

The introduction of the European Health Data Space (EHDS) Regulation is arguably the most significant regulatory event of 2025, even though main provisions take effect only from March 2029, with a transition period from 2025-2027. Sweden actively supports EHDS, viewing it as a priority for improving data access and developing new healthcare approaches.

EHDS creates a strategic fault line by requiring data unification for secondary use, making data accessible unless patients explicitly opt out. This directly contradicts existing culture and PDA legislation, which is based on an opt-in model (explicit consent). Resolving this conflict requires not just technical changes (implementing FHIR standards, bringing data to FAIR principles) but massive legislative work and open dialogue with citizens. Stakeholders including the National Board of Health and Welfare and Statistics Sweden are already participating in the SENASH project aimed at secondary data use.

To manage legal complexity posed by new technologies, the Swedish Authority for Privacy Protection (IMY) introduced Regulatory Sandboxes. The sandbox allows innovative initiatives like Federated Learning to receive in-depth, proactive legal clarifications on applying data protection legislation. IMY’s pilot project, conducted with Sahlgrenska University Hospital and AI Sweden, proved valuable for understanding legal challenges related to distributed AI model training on sensitive medical data. This demonstrates Sweden’s active pursuit of mechanisms to reduce regulatory risk that often constrains deployment of highly innovative solutions.

Key Regulatory Requirements Table

| Regulatory Framework | Scope and Function | Key Technical Requirement | Responsible Swedish Authority |

| GDPR | Personal data protection (EU-wide) | Strict Article 9 compliance (medical data); data transfer rules | IMY (Authority for Privacy Protection) |

| Patient Data Act (PDA) | Processing patient records in healthcare system | Confidentiality, usage limitations, right to review access logs | IVO (Health and Social Care Inspectorate) |

| EU MDR/IVDR | Safety and efficacy of medical devices/software | CE marking, clinical evaluation, technical documentation compliance | Läkemedelsverket (Medical Products Agency) |

| EHDS Regulation | EU-wide data exchange and secondary use | Mandatory standards (FHIR); transition to opt-out model; data quality (FAIR) | E-hälsomyndigheten (eHealth Agency) |

Technology Deep Dive: Implementation and Maturity

Artificial Intelligence in Clinical and Administrative Processes

AI is recognized as a key driver for improving quality, efficiency, and accessibility of healthcare in Sweden. 179 AI initiatives have been identified in Swedish healthcare, with most focused on critical areas: diagnostics, management, and administration. This reflects a strategic goal of using AI to reduce administrative costs and increase throughput, aligning with global investment trends.

AI Sweden, through its healthcare network, actively promotes data-driven approaches. Technology development focuses on solving data sensitivity challenges. Federated Learning (FL) is viewed as a key technical solution for developing multilingual clinical language models (Natural Language Processing, NLP). FL allows training models on massive volumes of medical text content generated daily without centralizing sensitive data, ensuring compliance with confidentiality required by PDA and GDPR.

Digital Therapeutics (DTx): Potential Versus Market Access

Digital Therapeutics (DTx)—software-driven, evidence-based interventions for preventing or treating diseases—has significant potential for reducing overall healthcare system burden.

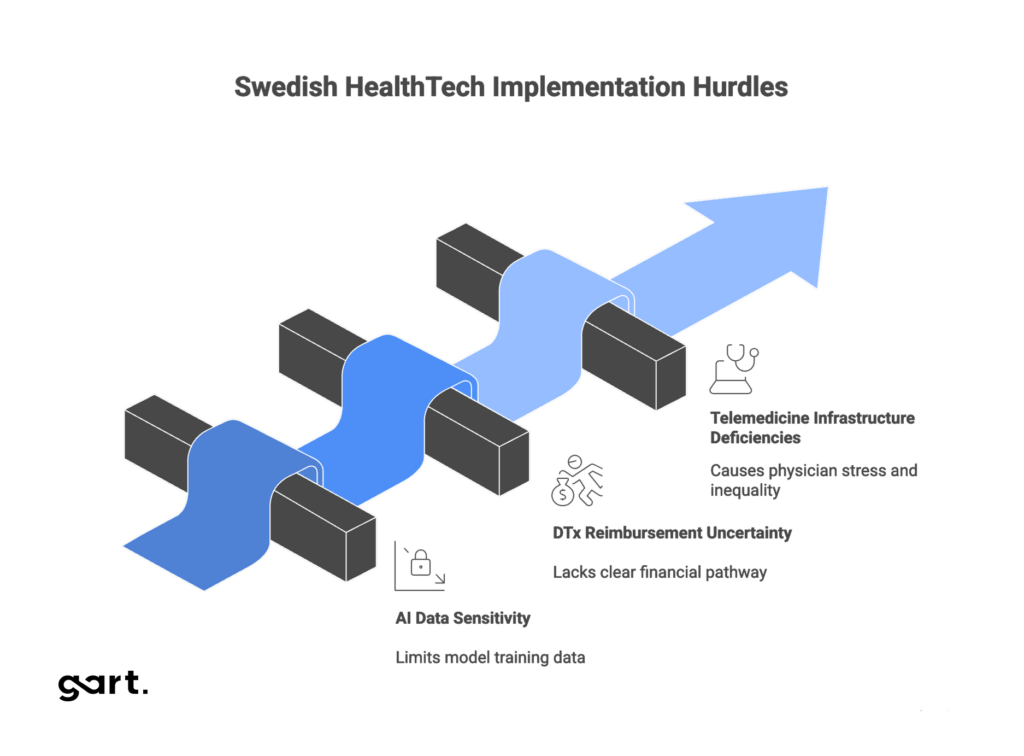

While DTx is regulated as medical devices under MDR, Sweden, like most European countries, lacks a standardized and transparent pathway for assessing clinical value and reimbursement. The Dental and Pharmaceutical Benefits Agency (TLV) handles reimbursement for some medical devices, but the absence of a clear “fast track” similar to Germany’s DiGA hinders commercialization. This lack of predictable financial pathway is a critical constraint. Despite DTx’s potential for improving efficiency and reducing system burden, scaling is limited, and investors and developers face high market entry risk.

Telemedicine and Remote Care

Sweden leads in digital medical services. Digital consultations surged, doubling to 2.4 million in 2020 (11% of total medical encounters). Services from local companies like Kry and Min Doktor are widespread.

However, telemedicine implementation faces operational and professional barriers. Primary care physicians in Southern Sweden express concerns about deficient existing technology infrastructure, need for additional work, and stress. Additionally, there’s significant concern about risks to patients, including potential exacerbation of healthcare inequalities and loss of multifaceted personal contact valuable for comprehensive patient assessment.

Critical Challenges: The Strategic Gap

Three critical technological and operational challenges must be addressed to successfully achieve Vision 2025 goals. These challenges create a strategic gap limiting innovation scaling despite the presence of advanced pilot projects.

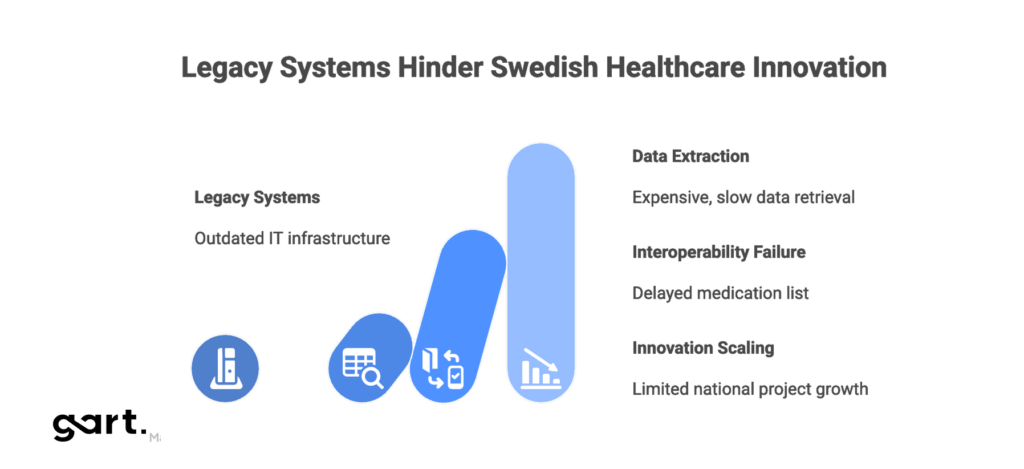

Legacy Systems Burden

The legacy IT systems problem in Swedish healthcare is fundamental. Existing Electronic Health Record (EHR) systems are difficult to integrate with modern digital platforms due to incompatible technologies, outdated APIs, and protocols. Failure to modernize these systems leads to significant operational inefficiencies and increased risk.

For example, unstructured data in some regional EHR systems (such as Stockholm) requires highly skilled data extraction experts with deep knowledge of international, national, and regional medical informatics, making the data extraction process for research and secondary use extremely expensive and slow. These operational issues directly threaten data integrity, confidentiality, and security.

Interoperability Failure: The FHIR Gap

Interoperability is a critical prerequisite for effective digitalization, clearly stated in the eHealth Vision 2025. HL7 FHIR (Fast Healthcare Interoperability Resources) is the modern standard enabling easy information exchange between different systems. While FHIR R4 is gaining momentum and expected to see significantly increased adoption, current implementation levels in Sweden are assessed as moderate.

The most visible manifestation of this gap is the delayed implementation of the National Medication List (NLL). Originally planned for 2022, NLL—designed to function as a secure, continuously updated resource for patients—was postponed to 2025, and now will likely only be achieved by 2028 or 2030 in some regions. Although NLL has already demonstrated benefits in improving information access, widespread implementation is constrained by high costs, lack of FHIR knowledge among stakeholders, and unclear guidance on national profiles.

Low FHIR adoption and NLL delays directly result from neglecting the need to ensure fundamental conditions (Area B) for digitalization. This creates a strategic constraint because even the most advanced AI pilot projects existing in Sweden cannot be scaled from regional initiatives to national level without a unified, reliable data exchange standard. Data fragmentation remains a barrier to innovation.

Strategic Recommendations: Framework Solutions

Overcoming these critical technological challenges requires a coordinated strategy combining regulatory intervention, innovative financing, and collaboration.

Accelerate Interoperability Through Mandate and Investment

Recommendation 1: Strategic Mandating of National FHIR Profiles

Sweden must urgently focus on developing and mandating national profiles (extensions and constraints) for key FHIR resources (Patient, Medication, Care plan, etc.). Establishing these profiles at national level will address the knowledge gap and clarity of benefits, providing a clear integration roadmap while ensuring data consistency necessary for EHDS.

Recommendation 2: Targeted EHDS Funding for FHIR Infrastructure

EHDS implementation requires €150-400 million in investments. Significant portions of these funds must be specifically directed not only to legislative alignment but to financing interface modernization and implementing FHIR gateways in regions. This will directly eliminate the high investment cost barrier currently constraining FHIR initiatives and prepare the system for FAIR-based data exchange.

De-risk Innovation Through Legal and Reimbursement Infrastructure

Recommendation 3: Institutionalize Regulatory Sandboxes (IMY/RISE)

IMY’s experience with federated learning demonstrated high sandbox value. These pilot projects must be transformed into a permanent, scalable mechanism. This will provide startups and major players with proactive legal guidance on applying complex legislation (GDPR, PDA) to new, sensitive data processing models (e.g., distributed AI training). Sandbox institutionalization reduces regulatory risk, accelerates AI solution time-to-market, and creates necessary precedents.

Recommendation 4: Create Specialized DTx Reimbursement Pathway

To unlock Digital Therapeutics potential, a transparent, accelerated process for clinical value assessment and reimbursement must be created (analogous to Germany’s DiGA model) in collaboration with TLV. Providing a predictable financial pathway maximizes DTx commercial potential, attracts venture capital, and ensures rapid patient access to these therapeutics proven to reduce system burden.

Modernize Core Systems and Infrastructure

Recommendation 5: Public-Private Partnerships (PPP) for Technology Lifecycle Management

Regions must more actively leverage PPP, where private partners (e.g., medical equipment and IT system providers) share financial risks and responsibility for technology lifecycle management. The PPP model guarantees scheduled equipment updates (right-sized technology refreshment) and digital solution integration, effectively addressing legacy system problems and incompatibility. This is particularly relevant given the growth of medical equipment segments.

Recommendation 6: Invest in Automated Data Capture Technologies (NLP)

Development and implementation of Natural Language Processing (NLP) in clinical settings must be prioritized for funding. This will enable automatic extraction, structuring, and analysis of vast volumes of unstructured medical text content contained in EHRs. Implementing NLP solutions directly mitigates reliance on scarce highly skilled data extraction experts and accelerates secondary use of clinical data for research and care quality improvement.

Critical Challenges and Resolution Pathways

| Challenge Category | Specific Technical Barrier | Industry Impact (2025) | Strategic Resolution Path |

| Interoperability | NLL delay (until 2028-2030) and low FHIR maturity | AI scaling limitations, high data integration costs | Mandate national FHIR profiles and targeted EHDS funding |

| Infrastructure | Legacy EHR systems and incompatible APIs | Critical security risk and dependence on rare data extraction experts | PPP for technology lifecycle management and system modernization |

| AI Governance | Legal uncertainty for Federated Learning under PDA/GDPR | Slowed innovation in sensitive data analytics | Institutionalize and expand Regulatory Sandboxes (IMY) |

| Market Access (DTx) | Lack of standardized assessment and reimbursement mechanism | Limited commercial success, unrealized system burden reduction potential | Create accelerated, transparent DTx reimbursement pathway (DiGA model) |

| Regulatory Shift | Transition from Opt-In (PDA) to Opt-Out (EHDS) for secondary data use | High risk of public distrust, need for million-euro investments | Legislative alignment of PDA/EHDS and active communication campaign |

Partnering for Modernization: How Gart Solutions Addresses Sweden’s Technical Blockers

The infrastructure challenges facing Swedish HealthTech aren’t unique to Sweden, but they require specialized expertise to solve effectively. Gart Solutions brings deep experience in healthcare IT modernization, working with organizations navigating exactly these kinds of technical transitions.

Our expertise directly addresses Sweden’s most pressing technical barriers:

Legacy System Modernization & Integration: We specialize in creating integration layers and API gateways that connect aging EHR systems with modern platforms, eliminating the need for costly full-system replacements while enabling incremental modernization. Our approach preserves existing investments while unlocking new capabilities.

FHIR Implementation & Interoperability: We’ve successfully implemented FHIR-based data exchange solutions across fragmented healthcare systems. We help organizations develop custom FHIR profiles, build integration engines, and create the technical infrastructure needed for seamless data sharing—exactly what Sweden needs to accelerate NLL rollout and EHDS compliance.

AI & NLP Infrastructure: From federated learning architectures that keep sensitive data distributed to NLP pipelines that automatically structure unstructured clinical notes, we build production-ready AI systems designed for healthcare’s regulatory requirements. We understand both the technical complexity and the compliance landscape.

Cloud-Native Architecture for Healthcare: We design and implement secure, scalable cloud infrastructure that meets strict healthcare data protection requirements (GDPR, PDA compliance), enabling Swedish HealthTech companies to scale solutions from regional pilots to national deployments.

DevOps & Technology Lifecycle Management: For organizations pursuing PPP models or managing complex digital health ecosystems, we provide DevOps expertise that ensures continuous delivery, automated testing, and systematic technology refresh cycles.

The gap between Sweden’s innovative pilots and national-scale deployment is fundamentally a technical execution problem. Gart Solutions serves as the implementation partner that transforms strategic recommendations into working systems. We work with HealthTech companies, regional healthcare providers, and digital health startups to build the technical foundation that enables innovation to scale.

For Swedish HealthTech organizations facing these infrastructure challenges, we offer not just technical services but strategic partnership—helping navigate the complex intersection of legacy constraints, regulatory requirements, and modern technology capabilities.

Conclusion: A Critical Year for Swedish HealthTech

Sweden has all the prerequisites to become a leading HealthTech innovation hub: significant public funding, high technological literacy, and powerful innovative entrepreneurship focused on diagnostics and decentralized care. However, 2026 is a year of critical decisions that will determine whether the country achieves its national Vision goals.

The central problem isn’t a deficit of innovation but a structural gap in implementing fundamental infrastructure (Area B) and regulatory uncertainty. Delays in key projects like NLL and legal collision between national PDA and EHDS Regulation create a bottleneck effect constraining the scaling of advanced AI and DTx solutions.

For Swedish HealthTech to succeed, the industry must adopt an aggressive strategy. This includes mandating and investing in FHIR standards, leveraging Public-Private Partnerships for scheduled replacement of legacy EHR systems, and most importantly, institutionalizing transparent legal pathways (regulatory sandboxes, DTx reimbursement). Only by decisively eliminating these technological and compliance barriers can Sweden transform its innovative pilots into nationally scalable solutions and cement its position as a global leader in digital healthcare by decade’s end.

The opportunity is there. The question is whether Sweden will seize it in 2026

See how we can help to overcome your challenges