Getting a new app or device to connect with a hospital’s old EHR system can feel nearly impossible. Many healthtech leaders have seen their first integration attempt stall before it even gets off the ground. The reason is simple: most patient records sit in decades-old systems that don’t have modern APIs. The result? Data stays stuck in silos and everyday workflows slow down.

In reality, a patient’s medical history is often scattered across different systems—surgery, radiology, billing, labs—none of which talk to each other. Staff end up re-typing or even faxing information just to keep records consistent. This not only delays decisions but also drives up costs and risks patient safety.

Most integration problems boil down to a few big issues: outdated systems with no standard interfaces, large data silos, and strict security requirements that must be followed at every step. Because of this, IT teams often have to build custom “bridges” between systems. But those one-off fixes are slow, expensive, and fragile—they need constant upkeep and quickly turn into a burden.

That’s why traditional EHR integrations often drag on for months, eat up budgets, and carry high risks.

Some of the most common challenges include:

- System Incompatibility: Legacy EHRs and hospital systems often speak proprietary, non‑standard data languages. Without APIs, integrating them requires custom adapters or nightly batch jobs. This is laborious, brittle work that strains timelines and budgets.

- Data Silos: Each department or vendor keeps its own data store, and lack of a common format means patient records stay locked in silos. Clinicians are left piecing together a patient’s history by hand, wasting time and risking duplicate tests.

- Long Timelines & High Costs: Custom integrations are slow. Industry analysts note that connecting two EHR systems typically takes 1–6 months or more, and can cost upwards of $30K–$150K. Each added requirement or vendor delay compounds the schedule, pushing projects past initial estimates.

- Security & Compliance Risks: Healthcare data is highly sensitive, so any integration step must be airtight. Improperly secured interfaces can expose protected health information and trigger fines. In fact, experts highlight that ensuring end‑to‑end encryption, tight access controls, and adherence to HIPAA/GDPR rules are major hurdles in any integration.

These hurdles mean that in many organizations, a new EHR connection still feels like a year-long ordeal. Teams waste time on custom parsing logic and security audits, when what they really want is a plug‑and‑play pipeline.

The High Price of Traditional EHR Integration

It’s no exaggeration to say that legacy EHR integrations can consume half a year of effort. One breakdown shows typical costs spread across phases: planning, core system work, security layers, specialty modules, and testing. Every extra interface point (say, to a lab or pharmacy) adds months. As a result, timelines stretch and budgets explode. And the result is often a brittle interface that needs constant attention:

“First, the integration timelines are stretched as the teams craft custom interfaces to match the legacy systems,” leading to “fragile” connections and ongoing maintenance needs.

The financial impact is clear. A recent guide notes that typical two‑system EHR integrations run from $30,000 to $150,000+. Those numbers don’t even capture the hidden costs of staff training, downtime, or the opportunity cost of delayed rollouts. Worse yet, each week of delay can have real-world consequences: delayed care, frustrated clinicians, and even patient safety risks when timely data isn’t available. In one case, a provider estimated that incomplete records led to a 20% spike in duplicated lab orders.

Perhaps most dauntingly, each custom integration is a potential security liability. Without modern tools, integrations often rely on brittle scripts or VPN tunnels. One security-focused review points out that “improper integration can expose PHI… to breaches, non-compliance fines, and reputational harm.” Even basic tasks like mapping user permissions across systems become complex when done by hand. In short, traditional approaches leave CTOs and CEOs with a painful choice: spend months and a fortune on roll-your-own interfaces, or risk non‑compliance and data risk.

Why Interoperability is Mission-Critical

This is why healthcare interoperability is now an industry mantra. By making systems interoperate from the ground up, we unlock modern digital health innovation. When done right, sharing data across care settings leads to faster, safer care and new business models. As DocVilla summarizes, “interoperability is the cornerstone of effective healthcare delivery,” enabling providers, payers, patients and other stakeholders to access and share critical health information seamlessly. Without it, patient data stays siloed in disparate systems, resulting in fragmented care and inefficiencies.

Think of the goal of interoperability as creating a “single source of truth” for each patient. Modern standards like HL7 FHIR are a huge reason why this is even possible today. By using common data formats and APIs, we can treat each system as part of one big ecosystem. In fact, leading analysts note that a unified data approach – often called a data fabric – consolidates all data into one virtual layer. In this model, “healthcare data fabric consolidates data from across your entire ecosystem into a unified layer, creating a reliable single source of truth”. With that foundation, clinicians see a complete patient picture, researchers access big data for AI, and operations teams automate workflows end-to-end.

Interoperability also powers innovation. When systems can easily exchange information, HealthTech companies can build new services faster.

Need to send a telehealth consult note to the primary care EHR? Done.

Want to pull wearables and claims data into an analytics engine? Real‑time ETL can do it.

Unified datasets fundamentally changes how care is delivered, how operations run, and how innovation happens. In other words, EHR integration and interoperability are not just IT puzzles – they are enablers of the next generation of healthcare (AI diagnostics, population health, virtual care, and more).

A Practical Approach: Gart Solutions’ Interoperability Toolbox

So how do we actually achieve all this without a 12-month headache? Gart Solutions tackles the problem with a modern, standards‑based toolkit tailored for healthcare. Instead of coding every interface from scratch, we leverage industry standards and reusable components to dramatically speed up onboarding.

Here’s how we make EHR integration simple:

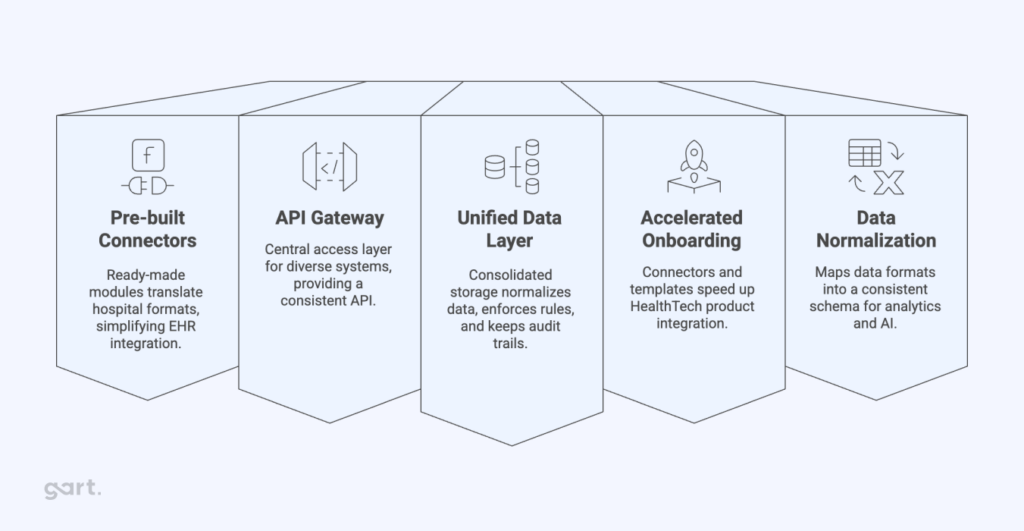

Pre-built HL7/FHIR Connectors

We provide an extensible library of adapters for common healthcare interfaces. These connectors handle the parsing and transformation of HL7 v2 messages and FHIR resources out of the box. For example, whether it’s a lab system speaking HL7 or an Epic/Cerner FHIR API, the heavy lifting of message translation is already done. As one case study notes, modern healthcare pipelines “need interoperable APIs (FHIR, HL7), … and Gart can deliver that.” In practice, this means we can plug into a hospital’s ADT or lab feed with minimal coding, rather than building each parser by hand.

API Gateway for Healthcare Data

Our integration layer uses an API Gateway as a secure front door to health data. This gateway registers all the endpoints (inbound and outbound), enforces authentication/authorization, and routes data between systems. In effect, we create a unified API layer over disparate systems. Any app or service can now call a standard endpoint in our gateway, and we handle connecting it to the right EHR or database under the hood. This delivers security by design (all calls go through our controlled gateway) and dramatically simplifies management of connections.

Unified Data Layer

We build a common, normalized data layer that sits between the hospital systems and client applications. As data arrives from an EHR or device, we map it into a standard model (e.g. FHIR resource objects). This means all downstream systems work off the same “language.” It also enables easy data sharing: once one system posts to the layer, others can subscribe or query. This approach is akin to a data fabric – a single truth – as industry analysts advocate.

The benefit is huge: rather than juggling multiple data formats, every team interacts with one clean, unified view of patient records, labs, meds, etc. This normalization step also takes care of coding differences (mapping “heart attack” to a code, aligning units, etc.) so that nothing is lost in translation.

Accelerated Onboarding

By combining connectors, our gateway, and unified layer, we eliminate most custom coding. In practice, this has slashed integration projects to a fraction of the usual time. Deployments that used to take 6–12 months now often happen in 1–2 months. In fact, industry data confirms the impact of these modern approaches: providers using FHIR report cutting integration time “from months to weeks”. Gart has seen this firsthand – for instance, integrating a new telehealth platform with a hospital EHR once took just a couple of weeks once our FHIR adapter was in place.

Security & Compliance by Design

Every component is built for the strictest healthcare regulations. Data is encrypted end-to-end, access is controlled by roles, and every transaction is logged for audit. We enforce HIPAA, EU GDPR and other standards at the infrastructure layer. (As HIMSS notes, GDPR governs “all processing and storage of data relating to data subjects” in Europe) In practical terms, our platform includes features like consent management, data de-identification (when needed), and regional data residency. The unified layer also makes it easier to enforce consistent policies: one security rule at the gateway applies uniformly across all systems. As a result, our clients meet security requirements with much less effort than building integrations ad hoc.

Altogether, this toolkit is what we mean by true healthcare interoperability solutions. Instead of one-off scripts, we offer a standardized stack that manages EHR connections, data flow, and compliance in one place. It’s the difference between building a house brick-by-brick and plugging into a fully plumbed architecture.

Real-World Impact: Faster, Secure EHR Integrations

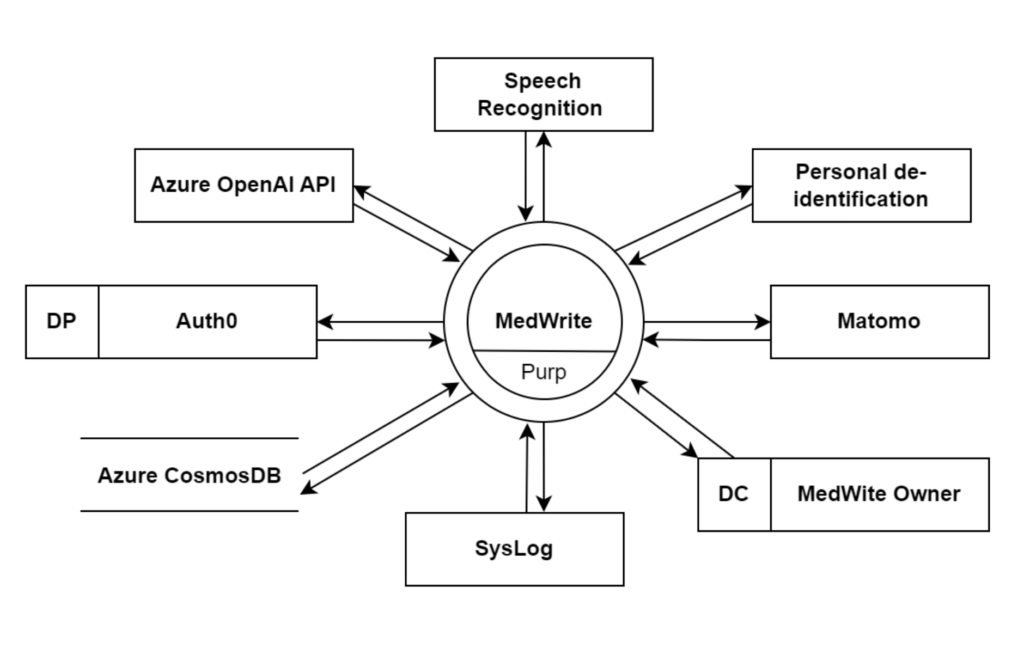

A strong example of what seamless, compliant healthcare infrastructure can achieve is our collaboration with MedWrite.ai—a startup reinventing hospital discharge workflows with AI.

MedWrite.ai faced challenges that will sound familiar to many healthtech leaders:

- Heavy admin workload for doctors, with discharge letters taking time away from patient care.

- Clunky IT systems that slowed down data access and communication.

- Strict compliance requirements (HIPAA, GDPR, SOC 2, ISO standards).

- Scalability needs, since AI-powered apps must run reliably at scale.

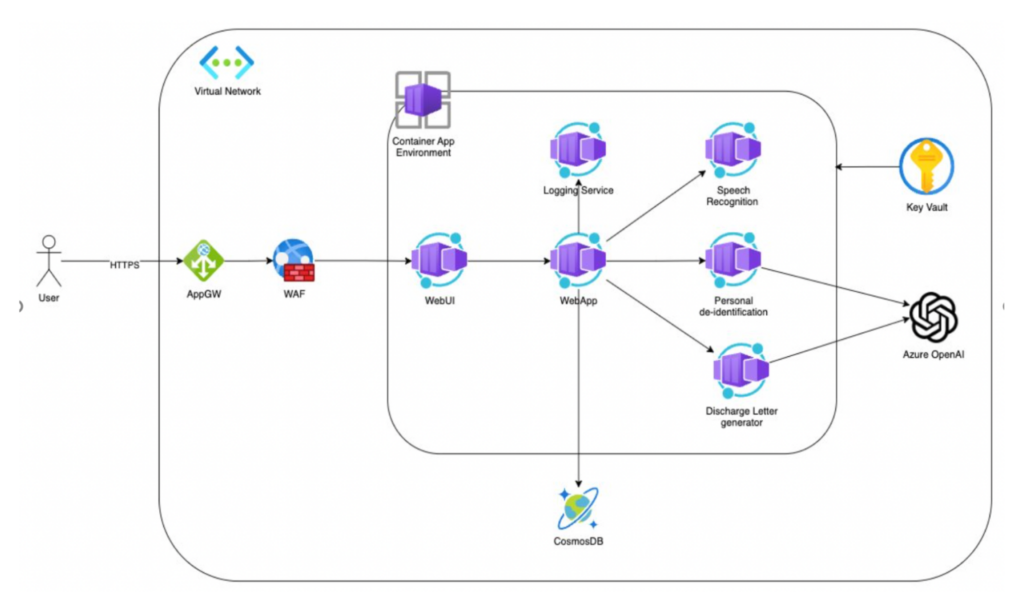

Gart Solutions stepped in to design a secure, compliant, and scalable Azure cloud infrastructure. We combined Landing Zones, Infrastructure as Code (Terraform), and automated CI/CD pipelines with robust monitoring, backups, and multi-layered security controls. This ensured 99.9% availability and dramatically reduced deployment time—by as much as 60%.

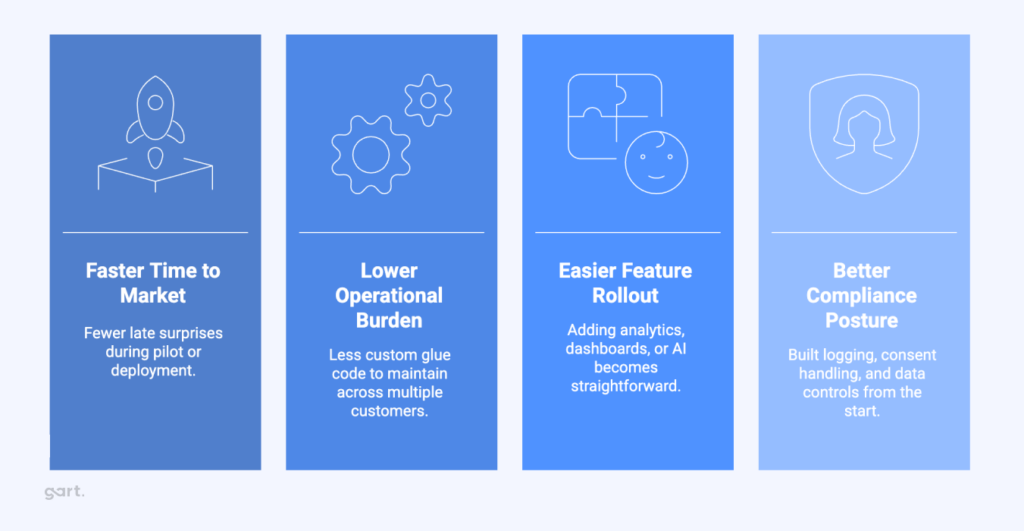

But beyond the technical wins, the business impact was clear:

- MedWrite’s team could shift focus back to AI innovation, rather than firefighting infrastructure issues.

- Doctors gained a system that reduced administrative burdens, enabling them to spend more time with patients.

- Hospital IT gained a cloud foundation that was future-ready, scalable, and audit-proof.

This project shows how the right approach to EHR integration and healthcare interoperability solutions doesn’t just solve compliance or scalability problems—it creates the conditions for medical teams and innovators to thrive.

Conclusion

In short, EHR integration doesn’t have to be a nightmare. With the right interoperability framework, HealthTech companies can focus on building great products – not wrestling with legacy IT. By using pre-built HL7/FHIR connectors, a robust API gateway, and a unified data layer, Gart Solutions turns complex integrations into plug-and-play processes. We bring deep expertise in healthcare security and EU regulations so that CTOs can check boxes and move on.

Put simply: the right healthcare interoperability solutions transform EHR integration from a roadblock into a competitive advantage. They let you get live with new customers faster, safely share patient data, and power the innovations of digital health. Whether you’re launching an AI diagnostics app or a telemedicine platform, our approach ensures your data pipeline is fast, secure, and compliant. Talk to us to see how Gart Solutions can turn “integration time” from months into weeks – without sacrificing any of the governance or security your hospital partners demand

See how we can help to overcome your challenges