For more than a decade, “cloud-first” functioned less as a strategy and more as doctrine. Enterprises were told that the public cloud represented the inevitable end state of modern IT: infinitely scalable, operationally simple, and economically superior by default. Migration became synonymous with progress. Staying on private infrastructure was framed as technical conservatism.

That assumption no longer holds.

As enterprises move toward 2026, a broad and data-backed reassessment is underway. According to multiple industry and financial studies, more than 80% of large enterprises are planning to move at least one significant workload off the public cloud within the next 12–24 months. This shift—often labeled cloud repatriation—is not a reversal of digital transformation. It is the next phase of it.

Repatriation is better understood as Infrastructure Maturity: the point at which organizations stop optimizing for speed alone and begin optimizing for unit economics, margin stability, performance determinism, and regulatory control.

The Cloud Paradox: When Agility Turns into a Financial Drag

The original promise of public cloud was compelling. On-demand infrastructure eliminated upfront capital expenditure, compressed time-to-market, and allowed teams to scale without friction. For early-stage products and fast-growing companies, this flexibility was decisive.

The paradox emerges later.

Once workloads stabilize, traffic patterns become predictable, and growth shifts from experimentation to efficiency, the same pricing model that enabled speed begins to erode margins. Variable consumption pricing scales faster than revenue. Network fees compound silently. Storage grows but never shrinks. Compute abstraction introduces performance overhead that must be offset with more instances.

This is the Cloud Paradox:

the infrastructure that accelerates early growth becomes a structural tax on mature businesses.

Venture capital and public market analysts have quantified the impact. Across large software companies, cloud spend has been shown to suppress gross margins by 15–25 percentage points. Because valuation is a function of gross profit, this does not merely reduce cash flow—it destroys equity value.

At scale, cloud costs are no longer an operational detail. They become a board-level concern.

From Agility to Efficiency: A Two-Stage Infrastructure Model

The emerging consensus among infrastructure leaders is not “cloud versus on-prem,” but phase-appropriate infrastructure.

Stage 1: The Agility Phase

In the early lifecycle of a product or platform, uncertainty dominates.

- Demand is volatile

- Architecture is still evolving

- Speed matters more than efficiency

Public cloud excels here. Elasticity, managed services, and global reach justify the premium. Paying for flexibility makes sense because flexibility is actively used.

Stage 2: The Efficiency Phase

As products mature, priorities change.

- Workloads enter steady state

- Usage becomes predictable

- Margins and cost per transaction matter

At this stage, elasticity becomes overhead. Enterprises continue paying for burst capacity they no longer need, for abstraction layers they cannot tune, and for network paths they do not control.

Infrastructure Maturity means recognizing when a workload has crossed from Stage 1 to Stage 2—and moving it accordingly.

Deconstructing the Cloud Tax

The “cloud tax” is not a single line item. It is the cumulative effect of multiple structural costs that only become visible at scale.

1. Data Egress and Network Friction

Ingress is cheap. Egress is not.

For data-intensive workloads, network charges routinely account for 20–40% of total cloud spend. Cross-region replication, analytics pipelines, AI training data, and customer exports all trigger fees that are difficult to forecast and harder to optimize.

This creates economic lock-in: data can enter easily, but leaving is expensive.

2. Virtualization Overhead

Public cloud relies on deep abstraction. That abstraction introduces measurable performance loss—typically 5–15% per workload—which must be compensated for with additional compute.

For high-throughput databases, AI inference, real-time analytics, and latency-sensitive systems, this overhead translates directly into higher cost per request and inconsistent performance.

3. Cost Volatility

Usage-based pricing creates financial unpredictability. Infrastructure becomes a variable expense tied not just to growth, but to architectural decisions, user behavior, and even API design.

For CFOs and boards, this volatility complicates forecasting, valuation, and long-term planning.

Cloud Repatriation in Practice: What the Data Shows

High-profile cloud repatriation efforts over the last few years illustrate the maturity model in action.

- Software companies with stable SaaS workloads have cut infrastructure spend by 50–70% after moving storage and compute to colocated or private environments.

- Data-heavy platforms operating at internet scale have demonstrated that owning hardware can reduce equivalent cloud costs by an order of magnitude.

- Large consumer services that repatriated core data years ago recovered their capital investments within 18–24 months and improved performance consistency.

The common pattern is not ideology—it is arithmetic.

AI as the Acceleration Force

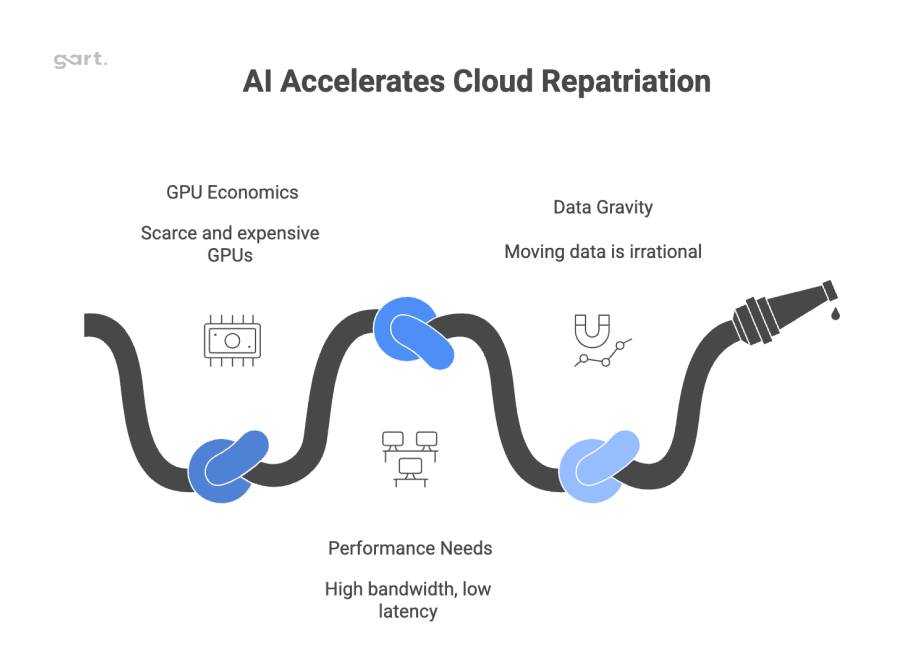

Generative AI is accelerating the cloud repatriation trend rather than reversing it.

GPU Economics

High-end GPUs remain scarce and expensive in hyperscale clouds. On-demand pricing often doubles or triples the effective cost compared to private or specialized bare-metal environments.

For teams training models over weeks or months, infrastructure cost can consume the majority of technical budgets.

Performance and Data Gravity

Large-scale AI training requires:

- High-bandwidth, low-latency interconnects

- Predictable GPU availability

- Proximity to massive datasets

These conditions are easier—and cheaper—to achieve in dedicated environments than in multi-tenant public clouds. Once data reaches petabyte scale, moving it repeatedly becomes economically irrational.

Regulation and Infrastructure Sovereignty

Cost and performance are no longer the only drivers.

By 2026, documented exit capability is becoming a regulatory requirement across multiple jurisdictions. Financial services, healthcare, critical infrastructure, and government-adjacent organizations must now prove they can disengage from cloud providers without service disruption.

This shifts repatriation from an optimization choice to a compliance obligation.

Infrastructure that cannot be exited is no longer considered resilient.

Read more: Digital Sovereignty of Europe: Choosing the EU Cloud Provider

Why Cloud Repatriation Is Feasible Now

A decade ago, leaving the cloud meant sacrificing operational convenience. That is no longer true.

- Modern deployment tools enable zero-downtime releases on bare metal with minimal operational overhead

- Kubernetes behaves consistently across environments

- Open storage and networking standards preserve portability

- Colocation providers offer managed facilities without hyperscaler markups

The operational gap between public cloud and private infrastructure has narrowed dramatically. What remains is a cost and control gap—and that gap favors maturity.

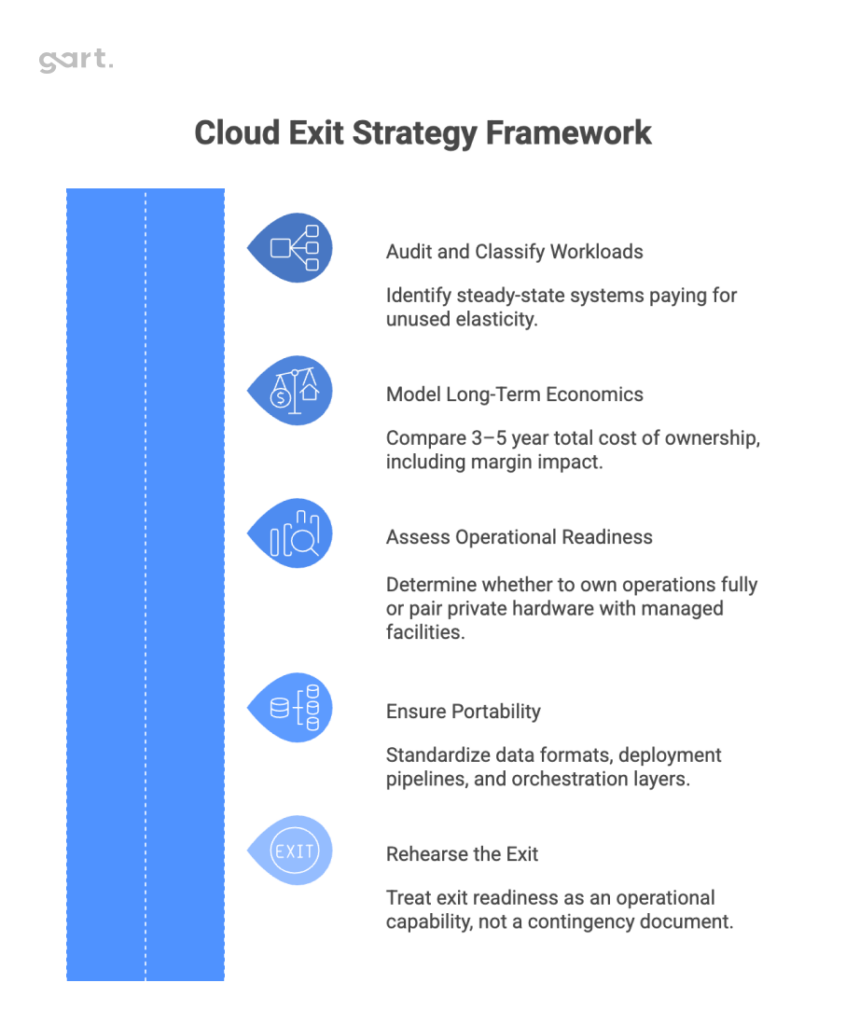

Building a Cloud Exit Strategy: A Maturity Framework

Successful cloud repatriation is selective, not absolute.

- Audit and classify workloads

Identify steady-state systems paying for unused elasticity. - Model long-term economics

Compare 3–5 year total cost of ownership, including margin impact—not just infrastructure invoices. - Assess operational readiness

Determine whether to own operations fully or pair private hardware with managed facilities. - Ensure portability

Standardize data formats, deployment pipelines, and orchestration layers. - Rehearse the exit

Treat exit readiness as an operational capability, not a contingency document.

The Hybrid Maturity Era

The future is not cloud-only or on-prem-only. It is hybrid by design.

- Public cloud remains the best tool for experimentation, global distribution, and burst workloads

- Private infrastructure anchors predictable compute, core data, and margin-sensitive systems

Enterprises that succeed by 2026 will be those that treat infrastructure placement as a strategic lever—not a default setting.

Repatriation is not a step backward.

It is the moment an organization proves it understands its own economics.

Strategic Priorities for 2025–2026

- Identify workloads that have outgrown elasticity

- Reassess AI infrastructure economics early

- Embed exit readiness into governance

- Standardize on portable tooling

- Elevate infrastructure cost to a valuation metric

The cloud was never the destination. It was the on-ramp.

Infrastructure Maturity is knowing when to change lanes.

See how we can help to overcome your challenges